It is time to start another crypto bot experiment. Today I am going to test out the Coinrule automated trading platform. This service allows you to easily implement your custom strategies and also use the templates with a pre-defined set of rules.

I will show you the setup process, and I will pick 5 popular Coinrule templates that are working with different strategies. You will see how the rules are created with this bot and what returns you can expect when trading with Coinrule.

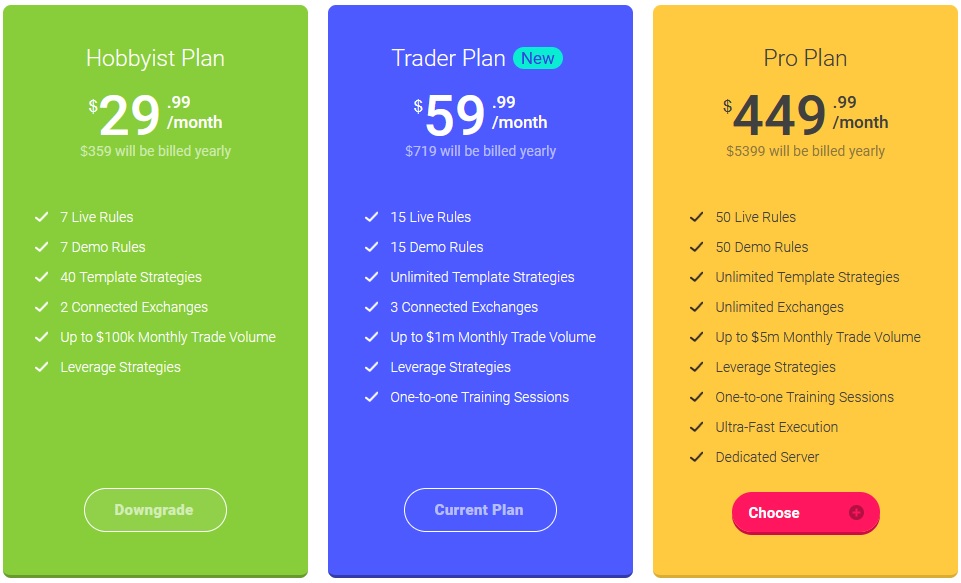

Choosing a Coinrule Plan

I have picked a Trader Plan which costs 59.99 USD (hello TV shop pricing). Basically, the main difference between all the plans is the number of Live rules you can launch and the trading volume monthly limits.

Trader Plan will allow me to run 15 rules at the same time. Today, for the first experiment, I will pick and launch 5 rules, just to understand how things work here. For the next Coinrule report I will already test all the features.

By the way, Coinrule has also a free plan that allows you to launch two rules. This is a nice chance for you to try out the service and decide if it is good for you.

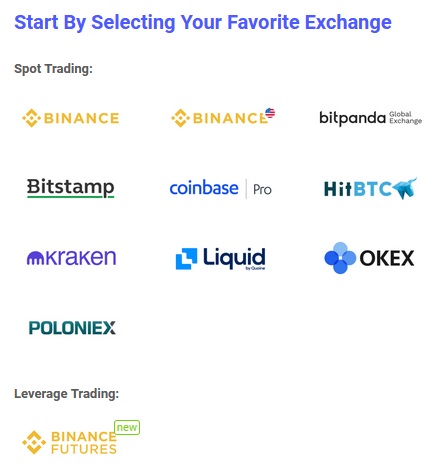

Once you choose the plan, you will need to connect with your crypto exchange via API. The list of exchanges is not that huge, but it is interesting to see Bitpanda is supported. This exchange became extremely popular in recent years but not that many bot services allow you to trade on it.

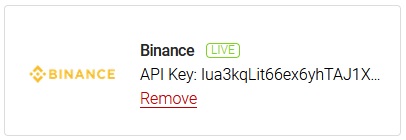

As always, to connect your exchange you will need to enter the API and Secret keys that are generated on the Binance website. I already have around 0.1 BTC on my Binance account and some BNB coin to reduce the trading fees.

Setting up 5 Templates

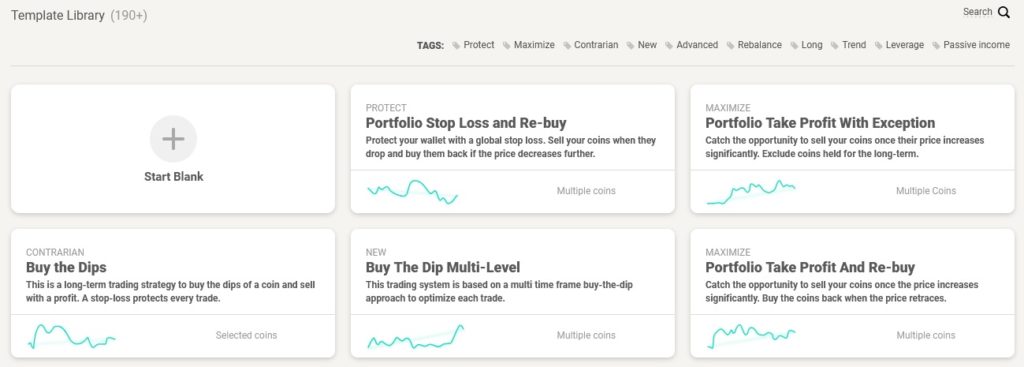

Now that my exchange is connected, I can start launching the bots. Coinrule has a huge library of templates for different goals and coins. As I only have BTC to trade with, I will need to pick the templates that are suitable to buy and sell coins with Bitcoin.

I will use the same size of the order for each of the rules launched, which will be the equivalent of 20 USD. As a default setting Coinrule offers to run each rule 10 times. Let’s keep this like that, so it will be easier to compare the results.

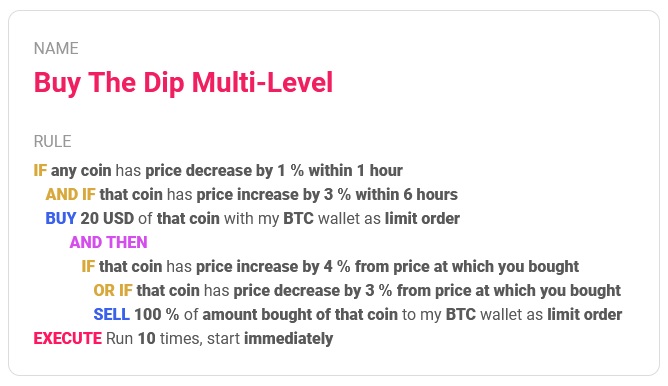

Buy The Dip Multi-Level

This will be the first rule that I am going to launch. Above you can see the informational box that appears after you launch every bot. This is the summary of the strategy that this rule is going to implement. The only thing that I change here is the size of the buy order: 20 USD.

You can clearly see how this rule will work. It will buy $20 USD of a coin with my BTC balance. Then it will try to sell all the coins when the price will increase by 4% and it also has a stop-loss feature set on 3%. The signal for buying the coin is a price decrease of 1% during the last hour after the coin increased in price by 3% during the last 6 hours.

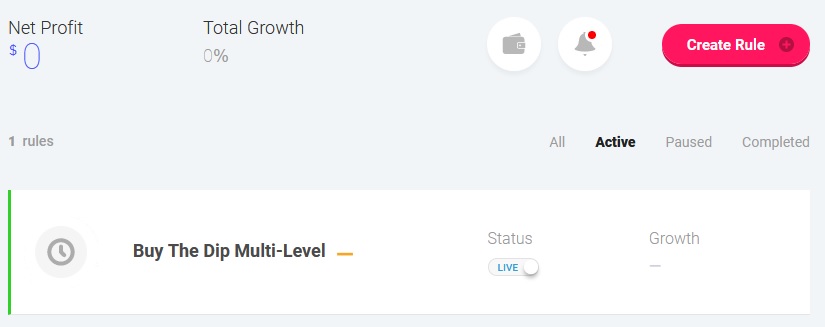

Now the rule is launched and Live!

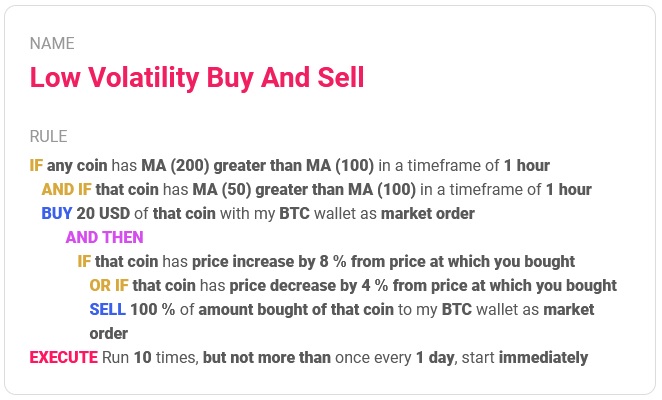

Low Volatility Buy And Sell

This rule uses the Moving Average indicator as a buy signal. As with the previous template, I did not make any changes to the strategy, but only selected the 20 USD order size.

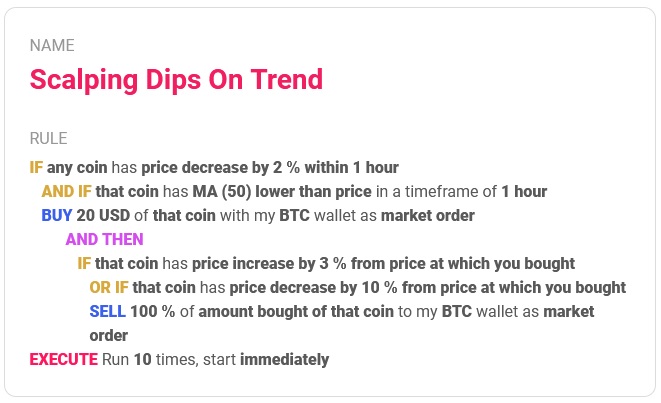

Scalping Dips On Trend

This rule is trying to catch the dip of a specific coin, using the Moving Average indicator again.

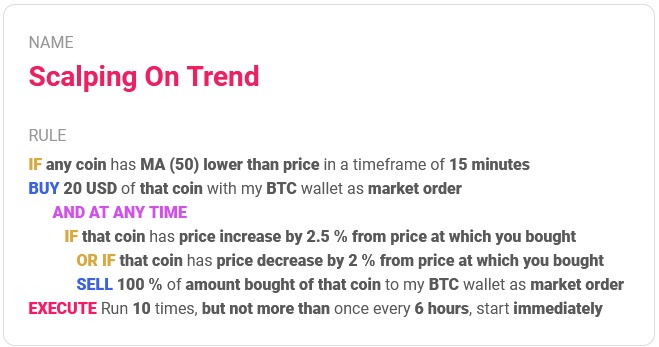

Scalping On Trend

This is another rule that is using the Moving Average indicator to catch a coin for buying. It would be interesting to compare how different setups around the same indicator work.

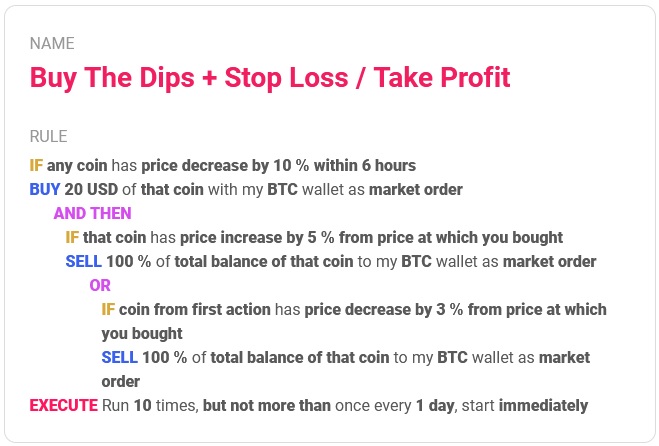

Buy The Dips + Stop Loss / Take Profit

The last rule for today is simply picking the coins that have dropped in value by 10% within the last 6 hours waiting for a price recovery.

First Coinrule Results

After several days I have received the first results that I am going to share with you. All the rules were set to execute 10 times, but not all of them were able to finish all 10 deals until now.

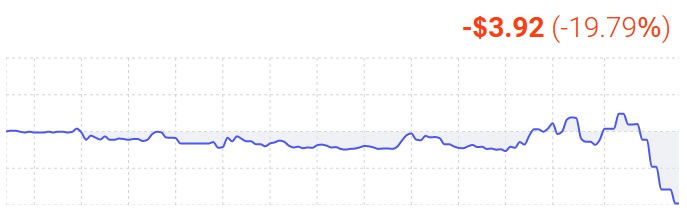

Buy The Dip Multi-Level

- Actions triggered: 10/10 times

- Exchange Fees Paid: $0.32

The first rule was able to execute all 10 orders, and finished with a negative result of -3.92 USD.

Low Volatility Buy And Sell

- Actions triggered: 1/10 times

- Exchange Fees Paid: $0.02

This rule was only able to buy one coin and still was not able to sell it. Looks like the price of the coin is stuck between the stop-loss and take-profit levels.

Scalping Dips On Trend

- Actions triggered: 6/10 times

- Exchange Fees Paid: $0.15

This is the only “green” rule that was able to make a small profit. It has performed 6 deals out of 10.

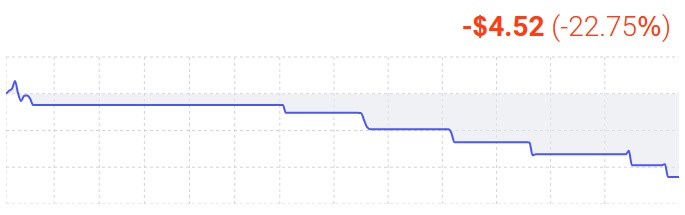

Scalping On Trend

- Actions triggered: 10/10 times

- Exchange Fees Paid: $0.36

The worst results I got are with this template. It has executed all 10 orders and according to the trading history, 9 of 10 were sold out after the stop-loss feature activation.

Buy The Dips + Stop Loss / Take Profit

- Actions triggered: 7/10 times

- Exchange Fees Paid: $0.21

Here all 7 orders have met the requirements for the stop-loss selling, which was 3% of the price decrease.

My Afterthoughts

While in terms of profit the results are not great, I am still happy about how the Coinrule bot worked. Full transparency is the biggest benefit related to this trading bot. You can set up every parameter yourself and polish your strategy according to the market.

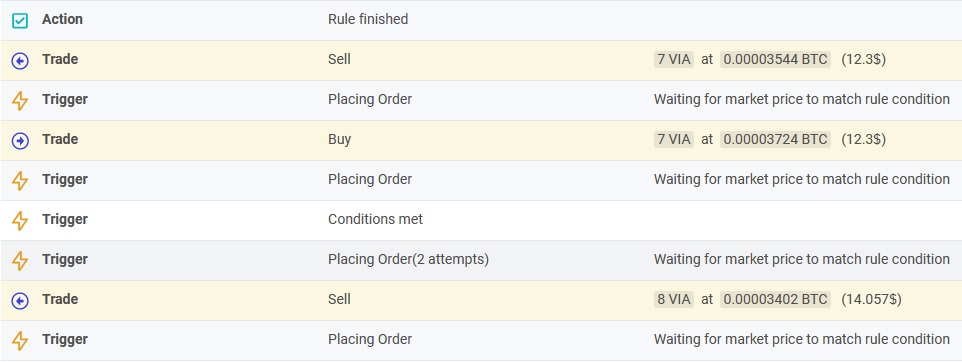

Every rule has its own history where you can see all the actions performed by the bot.

I did not lose much money on this experiment yet. However, now that I understand how things work it is time to use all the capacity the Trading Plan has on offer. There are still a lot of templates available for testing and I will launch maximum allowed rules to find out the best Coinrule templates.

In my next report, I will show you the results I receive and will also let you know if I decide to modify any of the pre-defined rules. The stop-loss and take-profit percentage is the first thing that might be adjusted in order to make the bot operate more efficiently.

lol,

thanks for the headsup.

interesting setup though. too bad of the results