A good trader will use everything they can to their advantage. Everyone knows that the cryptocurrency world is volatile and enjoyable with the right tools. Those who understand how to keep up with the market with the proper parameters and learnings can genuinely succeed and grow their portfolio value.

Today, we’ll talk about the idea of crypto signals and then talk more about the nature of cryptocurrency signals on the Cryptohopper automated trading platform.

What Are Crypto Signals?

Cryptohopper signals are trading suggestions that enable you to make more accurate buying or selling decisions. Signals are not a new concept as they were present since computers came about, and more enterprising individuals and speculation firms found ways to read the market and distribute these signals. These signals are now present in the cryptocurrency sector and are present due to multiple factors.

These inputs include technical analysis, up-to-date industry information, and the market’s current state. Several entities in the market provide and their signals on Cryptohopper. These entities can vary from discord groups, professional traders, and general trading groups.

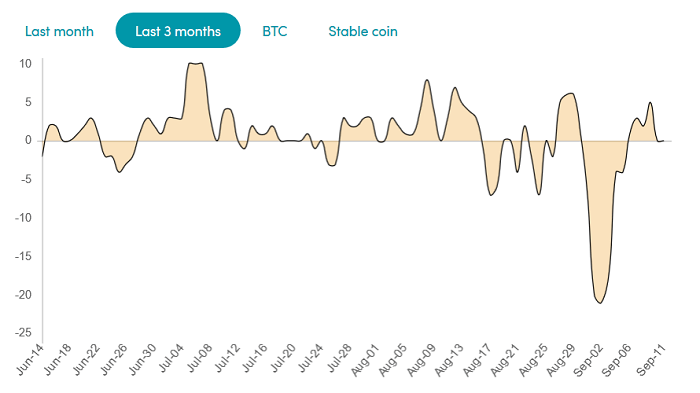

You will notice many of these entities within the sector and will want to be careful with how you interact and utilize these signals from people. Always do your own research but use these signals as a supplement. That is why you will always want to look for past data and signs of success in the past.

A verifiable history presented on Cryptohopper will serve you well. If not, you would be better off with your individual data consumption and translation over the long term. Indeed, if you don’t find verifiable parties, then you are better off going it yourself and gaining higher value.

Recall that that cryptocurrency speculation necessitates time, effort, commitment, and consistency. Many people do not have this naturally when they start within the sector. Those who seek to obtain free crypto signals when starting early on in the process can be a fantastic way to read more and comprehend more about the market.

What You Must Know about Crypto Trading Signals

Crypto trading signals are trading notions or speculation comments and posts. They are essentially notes to acquire or divest an individual asset at a particular price point and period. Now, these signals can occur through a human trader who conducts the research or through an algorithm or automated robot. The traditional finance world is seeing a significant rise in the more streamlined automatic solutions.

These suggestions would come with the point of making the acquisition or purchase and how to protect yourself via defensive actions such as setting a stop loss.

Originators of these components will make sure that it is an offensive and defensive play all around. But we are also noticing a rise in copy trading, where prominent platforms enable traders to copy other speculators’ actions.

One can gravitate to these platforms and earn by letting others simulate movements or learn by copying other people’s movements. This is like a more streamlined signal process because your portfolio will automatically replicate those trades. As such, you are not having to get the signal yourself and take the trading action.

Now, there are several types of digital asset trade signals provided at Cryptohopper. These include paid and non paid options. Those who are starting to speculate in the digital currency sector will begin with free signal groups before transitioning into crypto signal service peddlers.

Remember that signals are for short term movements, not long-term actions. That is why these signals must occur quickly, and one must seize the action in a fast manner.

Let us look at an example of a digital asset trade signal and view a cryptocurrency signal piece by piece.

The signal might say buy bitcoin at $15,000, seize profit at $18,000, and have a stop-loss order at 14,800. Now, let’s break this down. The first component of a signal will show what must do. Either acquire or sell. The next segment of such a system is to let you know which asset to obtain or divest yourself of. You are more prone to dealing with larger name-brand digital assets such as bitcoin or ethereum.

But you must purchase the asset at a specific price point, and that is the next component of a digital asset signal. Every single supplier worth their salt will let you know at what price point to acquire or divest your particular digital currency asset.

Of course, the price can vary where it can be what it trades at presently or where it will at a future point in the near term. The time to execute or when you will need to take action will vary based on the signal. They may ask you to do so quickly or within a point that gives you ample time to make the trade.

Now, you might not always purchase the asset at the exact price but may do so within a reasonable range. Remember also that different places like Binance may have slightly different prices due to market liquidity and action.

The next aspect the take profit and stop-loss set up. Each of these signals must come with this setup as it allows you to defend against volatility and preserve your capital. That is how you can minimize your risk while optimizing for your rewards.

When you implement take profit and stop-loss setups into your trade mechanism, you can go and enjoy your life without staring at the screen the whole time.

A few points to remember here is that you will likely receive another message that confirms that the target price did occur, when the profit-target took place, or when the stop loss was met. Providers will send out messages and updates on these calls because they want to simplify the process and ensure that traders don’t have to watch the charts manually.

Another intriguing element is that signals will be a part of specific digital asset entities. This means that you must have access to the exchange that the provider utilizes to be in sync with the provider’s call. The entities you will see that provide tend use will include Binance, Coinbase, and other large entities like BitMex.

Problems of the signals

The problem with signals is that they are merely signals and carry minimal information. They are just fine if they are accurate, but it is best to choose another one if not at a frequent level. The critical component here is the lack of information present within the signals. You don’t understand the why behind these moves, but you know when to execute and what to do.

Of course, most of the time, if you are succeeding, you will be fine. The lack of information is a blessing and a curse because it gives you simple clarity instead of excess confusion. Further, having stop losses and take profits will enable you to streamline your trading.

Additionally, just because signals say one thing doesn’t mean you must act on the signals. You can look at the analysis, view other charts, and make your decision.

You can do additional research or see if providers provide more context in executing your action.

The Chart Component

Holistic traders will view charts and input more effort in trade decisions and slowly understand more about the art of speculation. Then there are those who seek to earn as quickly merely, and as superficially as possible.

Speculators who want to follow the latter approach are more in line with having a relationship with a quality signals provider and remaining hands-off. As such, they can keep their current quality of life and not have to worry about diving into the fundamentals. Recall that cryptocurrency is not simple at all, and understanding how to make the right moves will not come in an effortless fashion.

Crypto signal providers such as Cryptohopper make sense because they can simplify the process and create substantial value. But if you are one person who loves to understand more aspects of the situation before making moves, then it is in your best interest to learn more about guides on technical analysis and charts.

Always remember that the more you can read and comprehend the charts yourself, the better off that you will be in making better decisions. As such, you can quickly check and then start to form ideas and opinions on the market’s future direction by yourself.

The beauty of learning is that you can send different neurons and wire new brain pathways, giving you more knowledge. As such, you can take more responsibility for your actions and understand why you are taking different steps. Instead of blaming others or being sad about something not working out, you can analyze and make decisions yourself.

Once you are starting, you can rely on signal providers. Still, as you grow and understand the industry, you must incorporate your chart data and other necessary information into your trading process.

Now, let us talk about Cryptohopper trading signals in details.

Cryptohopper Signals

Now that we know what signals are, we can look at how they work within Cryptohopper. Cryptohopper will enable you to utilize specific signals, not all, but a few of them within its platform.

When you navigate to your dashboard and configuration on Cryptohopper, you will see a tab for Signals on Cryptophopper. The Signals tab will enable you to configure your signals and choose several signals. You can check out the signals by clicking on view all signals.

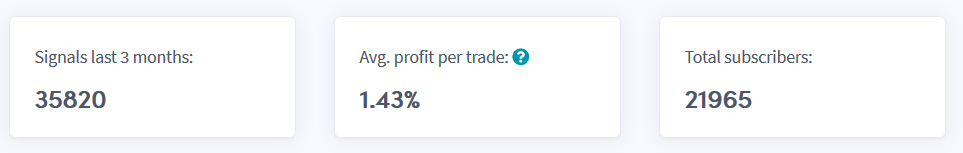

Remember that Cryptohopper states that signals are present by how well they perform. They will show up by accumulated profit as opposed to average profit, so it is all about how long they have been present in the market. The more reliable the signal service, the higher it will be in the rankings and longer it should stick around.

When you are ready to configure your subscription to a specific service you will see a pop-up box that states options. These options will include pause signal, market order, purchase amount in btc, percentage profit, percentage higher bid, percentage lower risk, sell signals, and additional features depending on your Cryptohopper subscriber level.

When you select a specific provider, you can see their details. Do they provide refunds? What is the default stop loss? The Bot settings? Live Support, and is there a Telegram Bot?

You will notice further details such as:

- Subscription fee

- Exchanges

- Weekly results such as average profit buy signals, total buy signals, average profit sell signals, and total sell signals

Remember that you can also see performance reports, real-time stats, and reviews.

You will likely notice that many providers will give you signals through your automated platforms like Cryptohopper and individual telegram groups. Then you will receive signals that may have three targets. Short term signals may reach within 2 days; the midterm will take on or two weeks to get to that price.

Now, remember that you can integrate signals within Cryptohopper to where it makes the trades based on the signals automatically. Options such as telegram bots that are automatically programmed with command messages, which enable them to trade seamlessly. With the right configurations, you can make trades simply and effectively.

On Cryptohopper, you will notice paid signals and free signals. Get comfortable with the free one’s and then transition to paid options as you grow your portfolio.

You will see the top ten weekly signals and more when you visit the signals listings page on Cryptohopper. Choose your signals provider, integrate with Cryptohopper, and you can make simple trades with one click or two.

That is about the gist of the matter and covers the various aspects of the Cryptohopper connection process. It is a straightforward process, but it is something that you must pay great attention to and learn as you go to become better and increase your profits.

As always, have fun and good luck trading!