In the past few years, the progression of the cryptocurrency industry has resulted in a lot of solution providers coming to the forefront. Whether they provide over the desk trading services or promise to hold your funds safe in their wallets, these entities are a dime a dozen.

While crypto exchanges had been all the rage a couple of years ago, the trend of growth has now shifted towards another subsector. If you have been involved with the industry for a while, it wouldn’t be difficult to guess that it pertains to trading bots.

Built with ease of use in mind, the bots let cryptocurrency traders buy and sell their assets automatically. After analyzing market trends, these algorithms take matters into their own hands and make targeted trades all on their own while letting traders focus on their day jobs or other income generation methods.

But even as these trading solutions promise the world to those who use them, not every tool is built to deliver every single feature on God’s green earth. Service features vary from platform to platform, and you might have to turn to a few of them before you find one that provides additional solutions that are considered vital for the modern trader.

Once such requirement is that of backtesting, which allows users to see their strategies in action before they implement them. Considered a very important part of modern trading bots, backtesting is an essential feature which is very much in demand by crypto traders.

To understand why the feature is so sought after and what it can do for you, here is all you need to know about backtesting and its optimal usage.

What is Backtesting?

As defined above, backtesting is used to determine the effectiveness of a strategy before it is implemented for real-world trading.

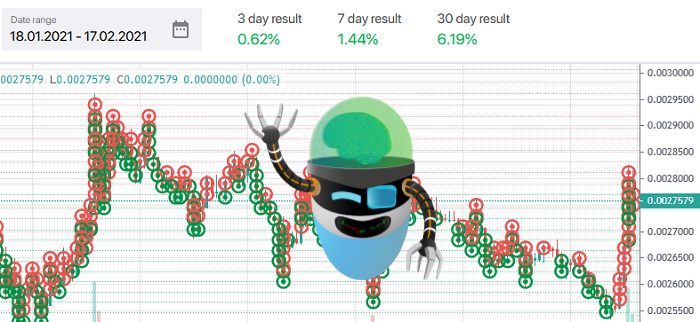

Bot solutions who offer this service essentially allow users to simulate their strategies against real-world usage to see how they would perform with actual funds. By executing strategies against historical market data, those who are using the backtesting features could see if their trading strategies hold any weight at all, or if they are prone to lose money by using them.

As a result, traders are able to get real market numbers against their strategies without actually having to spend any funds in terms of learning costs. That is why, bots that have backtesting are preferred more by traders as compared to solutions that don’t offer this service.

While the process might seem complicated, it is pretty straightforward.

In order to make use of backtesting, all you need to do is to setup your preferred currencies, select your trading pairs, and implement a predetermined or customized strategy.

From there, the bot simulates the preferences that you set against real market statistics from a defined past period, including dips and bumps in specified currencies as well as gains and losses that are incurred on mock-trades.

This way, you are able to get a clearer picture of how your funds would have fared if you had gone ahead with your preferred strategy in the past. These results give you a clearer path of the steps to take before you start fully-fledged trading with your funds.

In cases where the strategy only needs to be modified slightly, you could tweak it in order to make it more beneficial for yourself. On the other hand, in situations where your strategy doesn’t seem to be working at all, you could discard it completely before trying your hands on a better approach.

Given the simplicity and user interface (UI) of your chosen automated trading bot, setting backtesting features could be a very simple process that doesn’t require much from your end.

TOP TRADING BOTS

Can You Trust Backtesting Bot Results?

One of the biggest questions that comes to mind is if you can actually trust the simulated results. After all, who is to say that the bot isn’t simply manipulating the simulation for you to empty your pockets?

Thankfully, there’s a very simple way of resolving this quandary.

By ensuring of the reliability of the bot, you can make sure that you are being provided with trustworthy results. As a rule of thumb, the more popular the platform is, the more reliable these results are going to be.

Keeping this in mind, make it a point to find out if your chosen automated bot is a well-known entity in the cryptocurrency sector. The level of service the platform has provided to its other customers would define how much you can rely upon its backtesting results or the historical data that it is using to generate them.

Similarly, if it is a new bot that doesn’t have much to show in terms of user history or reviews, then it is best to be careful and take the results with a grain of salt.

Is the Backtesting Feature 100% Correct to Rely On?

While credible cryptocurrency trading bots make sure that they provide accurate results in terms of backtesting, it is prudent to note that the crypto market is a rapidly evolving medium. Fluctuation takes place by the second, and not all sources are reliable enough to have recorded every bit of data from the past.

That is why, whenever you use the backtesting feature even from a credible crypto platform, make sure that you leave some room for adjustment.

By managing your expectations and projecting lower gains or higher losses against the provided results, you would be able to setup your trading strategies in a way where a slight turn doesn’t throw your wallet completely off the rails.

To summarize, while it is a good idea to take estimates from backtesting features, you should never treat the results as being 100% accurate.

What if the Bot Service Doesn’t Provide Backtesting?

If your selected cryptocurrency bot doesn’t provide backtesting services, then it doesn’t mean that it is not proficient enough to fulfill your needs. Many reliable platforms on the market do not offer backtesting services, but still provide reliable and much-needed features when it comes to actual trading.

Sometimes, even the most holistic of trading bots do not have backtesting installed due to various reasons such as lack of time for development, focus on other services, or algorithm-specific restrictions. But as specified above, these bots could still provide great services when it comes to actual trading.

Keeping this in mind, make sure that you are not just judging your chosen bot solution on the availability of its backtesting feature. If the platform is credible, has been operating since a while, and has a large user base with rave reviews, then that is also enough for it to be used.

When this happens, you might need to take matters into your own hands and use a separate but reliable bot for backtesting with no charges, and your primarily chosen one for actual trading. The process might be stressful, but it is always good to do your due diligence and have an idea of what you are getting into before you start with real money.

Conclusion

Similar to other trading mechanisms, backtesting is not the only aspect that you need to rely upon. It is just a part of the larger tapestry, which is why you need to make sure that while you keep this feature in mind, you do not select or leave behind the bots because of it.

If trading bots offer free backtesting services without asking for your private information, then you can use a few of them to see how their services would have treated your funds against past market data. But always ensure that you eventually select a platform that is reliable, historically credible, and boasts of a large user base.

As long as you keep these tips in mind, you would be able to use backtesting in a way that is safe and reliable for your funds.