After half a decade of being cast in the shadows, the cryptocurrency industry is advancing at a significant pace.

In the last two years alone, it has come forward with investment opportunities that have given traditional markets a run for their money. And this growth is garnering the attention of old and new investors alike.

This includes professional daytraders who have been trading conventional assets for a while and those who have no previous experience but still want to delve into the new markets.

For both of these market segments, trading bots seem like a blessing from heaven itself.

As automated programs that perform trades even in the absence of the trader, these automated solutions could prove to be quite helpful in time, cost and risk management. Due to the advantages that they bring to the table, more and more trading bots making their debut every other day. Today we shall review the features of Kryll bot, which is one such tool.

Review

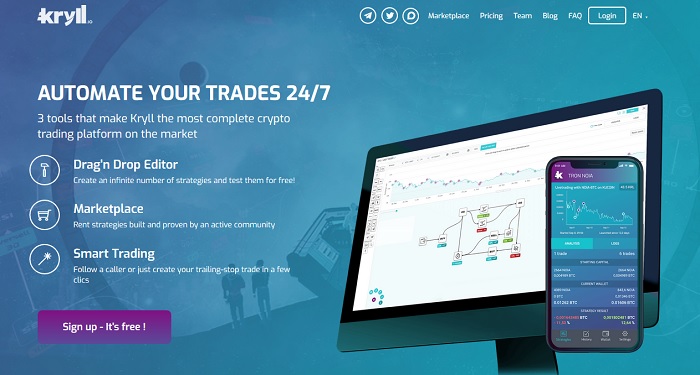

Launched in 2018, Kryll is a cryptocurrency platform that performs automated trading for its users.

The service focuses on making the trading process easier for users, whether they are professional daytraders or fresh traders wanting to benefit from digital currencies.

For this, Kryll bot uses a “drag and drop” feature for applying preset and customized strategies to any trader’s account. Once the strategies are setup and approved by the trader, the bot executes the buying and selling of cryptocurrency automatically.

During its trade execution, the bot makes use of market trends, indicators, and triggers. It also utilizes TradingView advanced orders through the program’s integration. It then makes the most accurate trades according to the strategy that it has been set to follow.

This way, traders could benefit from different automated trading strategies regardless of their personal level of experience with cryptocurrency. They also don’t have to be stuck to their computer screens all day long, since the trading bot keeps making trades on their behalf 24/7.

Apart from dragging and dropping strategy elements on their own, traders on Kryll can also follow more experienced daytraders to replicate their strategies. This social aspect allows each user to buy custom strategies, and also offer their own strategies to be sold in order to monetize their experience.

And before applying these strategies, traders could backtest them in a live simulation environment. This lets strategies prove their mettle before they are sent out to do the work in the real world with real money. This serves as a cost and time-saving feature for all levels of traders.

What sets Kryll apart from other crypto trading bots is its fee mechanism. Instead of using a monthly subscription, the platform charges its traders on the basis of their usage.

The platform also uses its own blockchain token that goes by the name of KRL. Those who hold a certain amount of KRL could get benefits on trading fees, which provides an incentive to those who want to use the platform regularly.

Time in Business

Kryll was launched through an initial coin offering (ICO) in 2018. It was released for the public in January 2019. This makes it quite a new platform, especially when compared with other, more established trading bots.

Since its public release, the platform has started gaining traction amongst the crypto community due to the benefits that it offers to its users.

Given that most traders in the cryptocurrency sector are solely focused on utilizing trading as a mode of income for the very first time, Kryll’s block-like strategy building structure makes it quite a helpful solution for them.

While the fee structure is a bit complicated to understand for novice users, it is not impossible to comprehend. Anyone could get acclimated with it by spending a few minutes to read through the introduction of the mechanism. And when they do, the affordable costs instantly make Kryll bot stand apart from the crowd.

In addition to these qualities, Kryll’s backtesting and social connectivity aspects add to its value proposition. When all of these features are put together, the service brings a strong offering to the table that has helped it grow in such a little time.

TOP TRADING BOTS

Reputation

Over the past year, Kryll has gradually yet surely obtained a certain level of reverence amongst its users. Apart from professional critics who sing praises for the platform, the trading bot has also earned positive reviews from users.

With that being said, Kryll is still lesser known than its more popular competitors. Once again, this is mostly due to its fee mechanism and the involvement of its own utility token.

Exchanges Supported

Despite being new in the sector, Kryll supports a number of crypto exchanges.

At the time of writing, the list includes:

The platform supports all cryptocurrencies that are listed on each exchange. This way, traders don’t have to worry about being restricted on the use of certain digital assets.

Price

As mentioned above, the pricing structure put forth by Kryll is what makes the platform so interesting yet so convoluted at the same time.

Instead of following a monthly subscription model, Kryll charges its traders on each use.

There are no fees for creating strategies or backtesting preset strategies that are free on the platform. But a fee applies when it comes to executing those strategies and actually using them to buying and selling cryptocurrency.

Kryll requires all traders to use its KRL token. This ERC-20 token is utilized to fuel the platform’s strategies. If a trader does not hold KRL, their strategies could stop the moment they run out of it.

This is a step that stops most users from using Kryll. It’s because KRL is only available on a few niche exchanges that are not as well-known. But in order to use Kryll’s services, users have to buy KRL one way or another from these exchanges.

The exchanges that trade KRL include Liquid, IDEX, MERCATOX, and Yobit.

Once a trader has purchased KRL, they can use it to fund their strategies. The price for each strategy funding depends upon the amount of tokens that a user holds in their account.

The fee structure is a bit complicated to understand. It’s important to pay attention to this aspect so that you don’t get baffled by certain charges in the future.

As a basic outline, Kryll charges 0.0333 percent per day for the amount that is invested in the strategy. Traders can get discounts on this fee if they hold a certain amount of KRL.

For instance, if a trader holds $500 without a KRL holding package, they would be charged $0.166 per day. There would be no discounts involved.

But if they hold 50,000 KRL, they would get a 50 percent discount on the total fees. This way, they would only be charged $0.083 per day.

These examples are cited directly from Kryll, and they are applicable on all trading amounts according to the amount of KRL held by a user.

At the time of writing, Kryll offers the following packages that each depend on the amount of KRL that you hold. The following features change with each package.

- Trading slots

- Fee discounts

- Referral bonus

- Backtest speeds

0 KRL

This package comes with 10 trading slots and a daily livetest cost of $0.06. It comes with no fee discount but boasts of a 20 percent referral bonus. It has regular backtest speeds.

5,000 KRL

This package offers 20 trading slots and a daily livetest fee of $0.05. It comes with a 15 percent fee discount and has a 25 percent referral bonus. It has regular backtest speeds.

20,000 KRL

This tier has 30 trading slots. It offers a daily livetest cost of $0.04. It boasts a fee discount of 35 percent and has referral bonus of 30 percent. It has boosted backtest speeds.

50,000 KRL

This package comes with 40 trading slots. It also carries a daily livetest price of $0.03. It has a 50 percent fee discount with a 35 percent referral bonus. It has boosted backtest speeds.

100,000 KRL

This particular tier comes with 50 trading slots. It also carries a daily livetest price of $0.02. With a fee discount of 75 percent and referral bonus of 40 percent, it defines itself as a value deal for many traders. It also has priority backtest speeds.

200,000 KRL

As the most advanced tier offer by the platform, this package comes with 60 trading slots and a daily livetest fee of $0.01. It also has a whopping fee discount of 95 percent. The referral bonus on this package is 45 percent. It also has priority backtest speeds.

Ease of Use

Kryll has a very easy to use interface that is also pleasing to the eyes. This makes the platform quite simple to operate for new and experienced traders alike.

At the same time, the process of having to buy KRL for fee structure is a bit complex for new traders and might even be termed as a hassle by some.

Apart from that, the overall platform is very simple to use. The extensive help section also assists users if they run into any issues.

Settings Available

Kryll trading bot has several traditional settings available for order types, which include but are not limited to stop-loss, take-profit, and moving average (MA).

All of these order types can be used through strategies, which all utilize a drag and drop feature for easy combinations.

Different blocks can be used for several order types, which provides trader the option to create very advanced strategies.

The integration of TradingView allows for further technical analysis indicators, which improve the platform’s functionalities by a large margin.

Security

Kryll is available as a web application, which means that traders don’t have to install anything on their computer.

Since the website is hosted on a secure server, it also allows for additional security. It also recommends traders not to check the withdraw option on exchange APIs, which adds another layer of safety.

But the platform lacks additional security measures such as two-factor authentication (2FA). Given that it is now a standard on trading bots, the lack of 2FA pushes Kryll behind its competitors.

Customer Support

Kryll’s customer service is based upon a ticketing system.

The platform has a detailed knowledge base. But if someone cannot find the answer to a question, then they could contact the customer support team by submitting a request.

This ticketing system is also applicable in terms of specific support issues.

Profitability

Similar to other trading bots, Kryll does not define the percentage of profitability against its operations. This is a standard approach to automated trading solutions, which saves them from liability.

If you are looking for a new crypto bot, it would be a good approach to test Kryll through its free strategy creator and backtesting features. From there, you could decide if the platform seems good enough to be given a paid trial.

Conclusion

All in all, Kryll remains a helpful trading bot with easy to use features. But a complicated price structure and lack of a free trial for full services might make it a second choice to many traders.