This is my third, and I think the final 3Commas bot report. Why did I decide to stop this experiment? You will find out a bit later. This decision applies to the DCA bot strategy because 3Commas also has Grid and Options bots that I might test in the future.

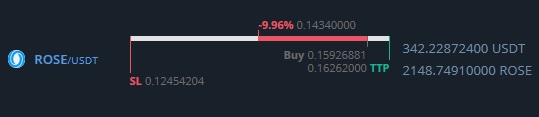

First of all, let’s try to remember what the status of my DCA bot was after the posting of the previous report. I had one active pair ROSE/USDT which was negative almost for 10%. The stop loss setting was 25% and I decided to make some changes to the bot settings after the stop-loss activation or if the pair will recover and make me profit.

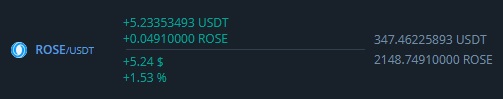

This situation resolved with a positive outcome and the 3Commas bot was able to sell the pair bringing me +5 USDT in profit.

After this, I have stopped my bot for a while to make two adjustments.

Lowering Stop-loss

The first change that I am going to perform is a lowering of the stop-loss percent. I will put it on the 15% and this should help me not to lose a lot of money if the bought pair will start to rashly drop.

On the other hand, the lower stop-loss might get activated more often, but this is the risk that I want to handle and test out.

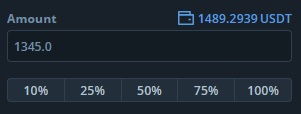

More Money for Trading

To scale out the profits I also decided to put more money in trading for my 3Commas DCA bot. The starting balance for this experiment was 345 USDT, and now I am adding 1k to it, making the total 1345 USDT.

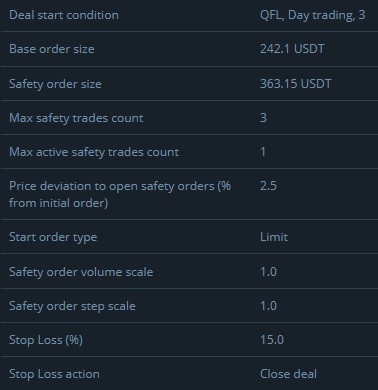

Now I re-launch the bot with these two new settings and here how the full setup looks like:

The idea of these changes is to give the bot more funds to work with and to lower down the losses if the stop-loss order will be activated again. Everything else will remain the same, except for the order sizes. As the bot has more balance to work with, the base and safety order sizes were increased.

The bot will work in the same way as before: once it receives the signal for buying it will place the base order, it will also place 3 safety orders after each 2.5% in price drops, and then the bot will try to sell everything.

If the price will continue moving down then a 15% stop-loss order will be activated. If the price will be growing, then a 2% take-profit order will be placed.

Profit Killer

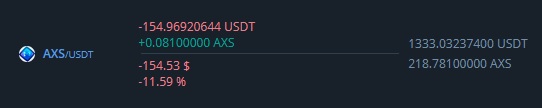

With the new settings the bot was able to make several successful trades, but after that the pair AXS/USDT was bought. This one became a total profit killer for all of my previous efforts.

The bot purchased the AXS coin, then made 3 more buys according to the DCA strategy to average the buying price, and then my 15% stop-loss order was activated.

As the result, I have lost 154 USDT which was a really painful loss. It would be interesting to check, whether the coin would be able to recover not hitting the old 25% stop-loss. I can’t say that my stop-loss adjustment was a mistake. This is an experiment and I am testing different scenarios, but the timing was very unlucky.

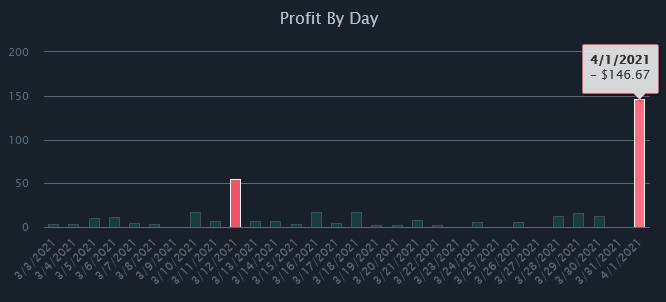

This deal has become a strong pain for the whole experiment, and here you can see the profit by day metric with this huge red bar:

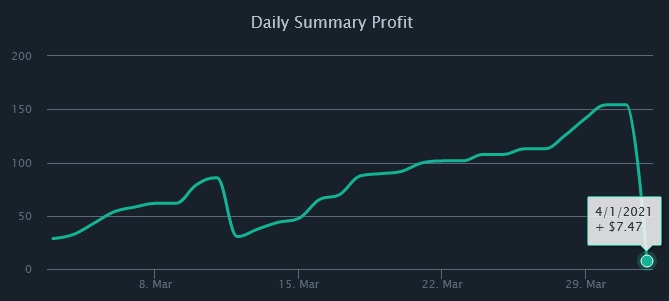

And this is the overall profit of my 3Commas DCA bot. As you can see only 7 dollars in profit are left after the unsuccessful deal:

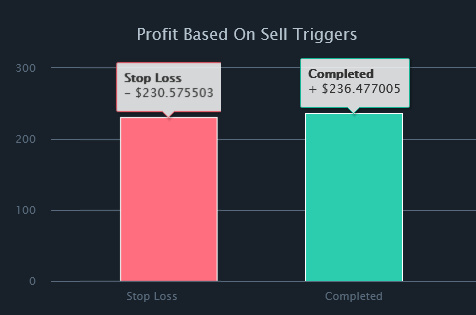

Here you can see all the profits and losses that the bot was able to get over the time of this experiment:

And my final screenshot will show you the amount of all completed deals:

The Final Verdict

Right now I decided to stop testing the 3Commas platform, at least with its DCA strategy. While I was not able to make any solid profit here, I still think that 3Commas is a strong tool for trading automation. The bot was running for 35 days, and during that time there were no errors and zero inappropriate orders placed.

The bot is doing exactly what you ask it to do. It is fully customizable, so you can apply any DCA strategy you want with several clicks. My job here is done. While making a profit is a nice goal, testing the features and functionality is also a good reason why I make such experiments.

So my final verdict is: if you are familiar with DCA trading strategy and know some bulletproof settings that can work well on the crypto market, then 3Commas is a good tool to use. If you are like me, who was trading a bit manually or was using another strategy, such as grid for example, then you can still try the free plan and play around with some smaller budget.

At the same time, if you want to be successful with DCA strategy you need to learn more about the settings and market conditions that this one can work well with. This series of reports is over, but 3Commas has two other types of bot that I might also test. The Grid one is not that interesting, as I am already successfully implementing this one with Bitsgap.

But another one, which is the Options bot, looks promising. I did not see that type of bot on any other automation service, so this is something unique and worth trying. The Options bot from 3Commas works only with one exchange Deribit, so I will require some time for preparation in order to put it to test.

Interesting report. I’ve been using 3Commas for over 10 months now and I’ve had similiar conclusions, but I went on further to learn more. Here’s the thing I learned so far.

1. Use DCA bots unless you tested them on Paper Trading. Your losing money while you don’t have too. Activate Paper Trading in your settings en testrun your DCA bots with fake money.

2. DCA + Stop loss is killing for your funds. You’ll lose more money then you want using the default bots and without a plan on which altcoins your trading.

3. That being said. Daniel is right you need to decide which alts you want to hold which you don’t. Make two seperate bots for example, one DCA bot for the hold altcoins without stop loss and one DCA bot that trades more risky alts with very low volume with a stop loss.

4. I’d experiment with SL values between 25 to 75% as the drops are very regular on low volume and low cap alts. Find out which alts have similar drops or pumps and add to together in a DCA bot.

5. Try going for the top 20 alts from Coingecko or Coinmarketcap, combine those in a bot. No stop losses. And let it DCA all the way down to the maximum possible drop (put up 30 safety orders with a 2,5% deviation if you have to). Since they’re in the top 20, they’ll move up eventually. And you’ll be surprised when it comes out in green in about 2-4 months.

6. Patience is key for bots. I usually test out bots for about 2-4 weeks on paper trading before I even think of putting them on my live account with real money. Even then I’ve had trades we’re underwater for three months and eventually came out in green. But that can’t be said for shitcoins. Patience patience patience (depending if you decide this strategy of course.)

7. I’ve been thinking about the ultimate DCA bot since I started with 3Commas (december 2020). When you trade manually you look for trendlines and support and resistance, based on that you decide what your TP and SL values will be. With TradingView and a paid subscription you can combine buy and sell alerts with 3Commas DCA bots. I’ve been experimenting with this for about a month now and I’m getting very interesting results. The only thing missing is stop loss that’s determined dynamically eg. by a algorithm (or Pinescript) and is filled in for that specific deal. I’m too caught up on work and school for now to learn programming languages and stuff. But this is the way to go if you want a selfsufficient DCA bot with riskmanagmenet in place.

8. Based on what I said at 7, a DCA bot that changes itself depending on market conditions. Try out the TA Preset > BB-20-2 or BB-20-1. Those are bollinger bands which are also a very powerful indicator that react on local trends. Same goes for QFL and CQS. Then use RSI, or TradingViews (Strong) Buy or (Strong) Sell Oscillator signals (That are available in 3C DCA bot settings) as an extra confirmation.

That 15% stop loss killed You, I prefer to have multiple low orders bots with a lot of safety orders, don´t confuse bot trading with normal trading, a bot can be stuck in a trade for weeks, days or even months, the whole idea of safety orders is that if the price goes down your bot will be buying the coin during the bear market, that way when it goes up it doesn´t have to go as up as your 1st order setted the take profit price. But at least You understood what it´s all about and technically didn´t loose money doing it.

Nice Answer.

Your safety must cover at least 30% drop even 45-50%

Stoploss for tokens you can hold is a mistake. I prefer setting up more safety trades so you DCA on the way down, so you take profit quicker if something crashes, also, 15% was too little for a stoploss.