Today I will share with you my grid bot trading strategy that helps me to accumulate Bitcoin during a bear (falling) market.

I call this a “no-loss” strategy, but this might not be the case for everyone. If you believe in Bitcoin and, in the same way as me, think that BTC will always grow in value in the long term, then you will find this strategy useful.

To execute this strategy, I will use a Bitsgap bot solution. It has some very useful features such as trailing up and trailing down orders that will allow me to create an infinite grid bot.

The essence of this Bitcoin accumulation strategy

The idea behind this grid trading strategy is very simple: we need to launch an infinite grid bot that will run on the BTC/USDT pair. This bot will buy Bitcoin for USDT when Bitcoin’s price moves down and sell BTC back to USDT when Bitcoin’s price recovers.

Why is this a perfect strategy during falling markets? Because it will allow us to buy Bitcoin at a cheaper price.

What’s the perfect moment to quit this strategy? Basically, as soon as you run out of USDT. This means that all your USDT balance was used to buy Bitcoin. Now you only have BTC on your account. Then, you can just stop trading and start holding Bitcoin until it gets to the moon.

You can also continue trading and let the bot sell your BTC back to USDT when the price starts to recover. As Bitcoin’s price is quite volatile, this strategy could work several bear/bull cycles.

The same strategy can also work the other way around. You can launch a bot on different trading pairs with BTC as the quote currency. This will let you accumulate BTC during bull markets. I will execute this strategy later and show you how it works in a separate report. Now, let’s move to the bot’s settings.

How to launch a BTC/USDT infinity bot?

Before launching this bot, you need to define whether the crypto market is growing or falling. There are many indicators that can help you to figure it out. But you can also rely on this simple logic: there is always a correction after any significant move, either up or down.

If you saw that Bitcoin price was growing for a significant period of time and it started a move down, then it might be a perfect moment to launch this bot.

What happens if you wrongly identify the trend of the market? Then you will start to accumulate USDT by selling Bitcoin. This is not a huge issue. Volatility and market cycles will sooner or later reverse the price.

Another aspect that you need to take into account is the availability of the assets you are trading on your balance. This particular strategy is much more comfortable to launch when you have USDT. We predict that the market will be falling, so we want to use USDT to buy Bitcoin at a cheaper price.

What if you don’t have any USDT at the moment? Well, you can also launch the bot with a BTC balance. It will instantly sell some of your BTC for USDT and use the dollar balance to buy Bitcoin back when it starts falling.

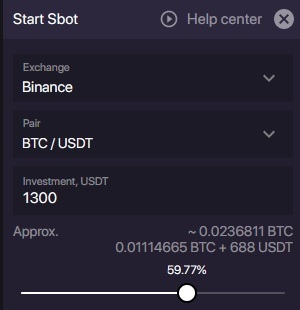

Now, here you have my settings for the Bitsgap grid bot to execute this strategy. The first part of the settings is related to the exchange that you will use, the trading pair you want to trade, and the investment amount. I will trade on Binance. My account has 2175 USDT.

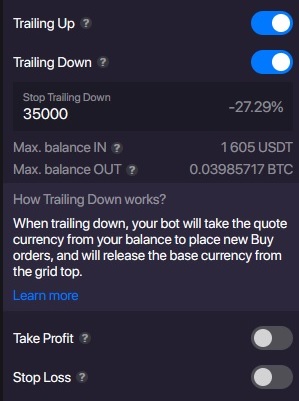

I will use 1300 USDT as an initial investment. The remaining funds will also be used for buying BTC, as I am going to activate the trailing down feature.

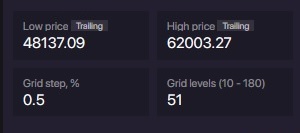

Next, I will have to define the trading range (low and high prices), the grid step, and the number of grids. The main parameter here is a grid step, which I always try to set at ~0.5% value. The upper and lower price ranges are not that important as we are going to build an infinite grid, which should move up or down together with the price.

The last part of the settings is related to the trailing options. I activate both trailing up and down features. The current BTC price is 54,943 USD and I have chosen 35k for the trailing down stop value. I don’t believe that Bitcoin will even get to this number before I run out of my USDT balance. Basically, this parameter is not that important. I will also not set any take profit and stop-loss settings.

Now, this is how the Bitcoin chart looks like after I launched the strategy. The red lines indicate the sell orders, green lines show the buy orders. We will accumulate Bitcoin when executing the green orders and sell it back to USDT on the red ones.

Results after 1+ months of running

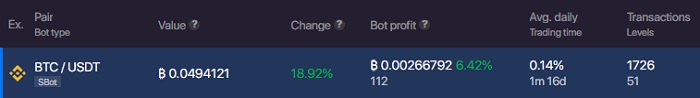

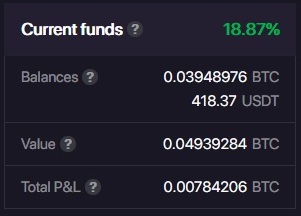

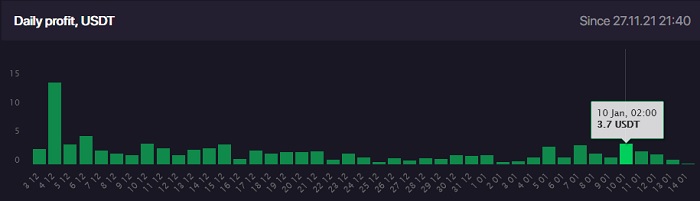

Let me now show you the results of this grid bot setup after 47 days of running. The bot has executed 1726 orders and the total value of my funds is 0.049 BTC.

As I expected, the price of Bitcoin started to move downwards, so the trailing down feature was activated. These are all the trades that the bot has executed so far. The current price of Bitcoin is 42,203 USD.

The main question here is the following: is the strategy working in the way that I was expecting? To understand this, let’s check the bot summary. It has a Current Funds section that will help to understand what happened with it.

As you remember, we started this experiment with 2,175 USDT when the price of BTC was 54,943 USD. If we decided to buy Bitcoin at that moment, then we would get: 2175 / 54943 = 0.039586 BTC.

What is the total value of my portfolio? It is 0.04939 BTC!

The bot was not only buying BTC at a cheaper price but it has also made some profit due to market volatility. It was buying BTC low and selling high during market movements.

The Bot will help you to find the dip

Some of my readers might be a bit skeptical about this strategy. A simple calculation will show that holding the whole USDT balance and buying BTC now would be more profitable: 2175 / 42203 = 0.051536 BTC.

That is true. But there is something to mention: you don’t know when the dip will happen and when it is the perfect moment for you to buy BTC. By executing this grid bot strategy you don’t have to think about finding the dip. The bot is steadily buying BTC through the whole market downtrend and will eventually reach the price at which Bitcoin starts moving lower organically on its own.

So theoretically, you could earn more by just waiting till Bitcoin will drop to some level, but in reality, you could also easily miss the opportunity. This setup will remove all the stress to monitor the market every day and catch the right moment.

Right now, I will stop this bot and use the balance to launch a reverse strategy with a pair in which BTC will work as the quote currency. This sort of strategy should accumulate Bitcoin when the market moves higher and, right now, I feel that we are entering a growth phase. Maybe I am wrong and the trend is still bearish, but anyway I will show you the results of this experiment in a new blog post. Stay tuned!