I am happy to report that today I generated the maximum profit I ever have, courtesy of Bitsgap trading bot. As you remember, I started my automated trading experiment 4 months ago by investing 0.4 BTC. Now, my balance is 0.445 BTC and it keeps growing on a consistent basis.

Frankly speaking, I could make a lot more if I was willing to spend more time adjusting my bots. Sometimes, my bots are leaving the trading range and making no profit. If I was looking over them on a day to day basis and making regular adjustments, I would be able to optimize them for maximum performance and generate more profits as a result. But for now, they are moving forward with weekly input from my end, and this week generated the best results to date.

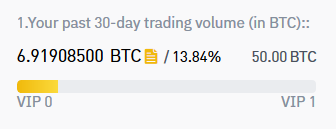

Apart from the bottom line in terms of profits, another merit of success of automated trading is volume. This month it is not that significant. It’s only 6.9 BTC for the last 30 days, which again tells me that the bots are not working on 100% of their capacity. This is an indication that I need to put more time in adjusting them, which is something that I fully intend to do in the next week.

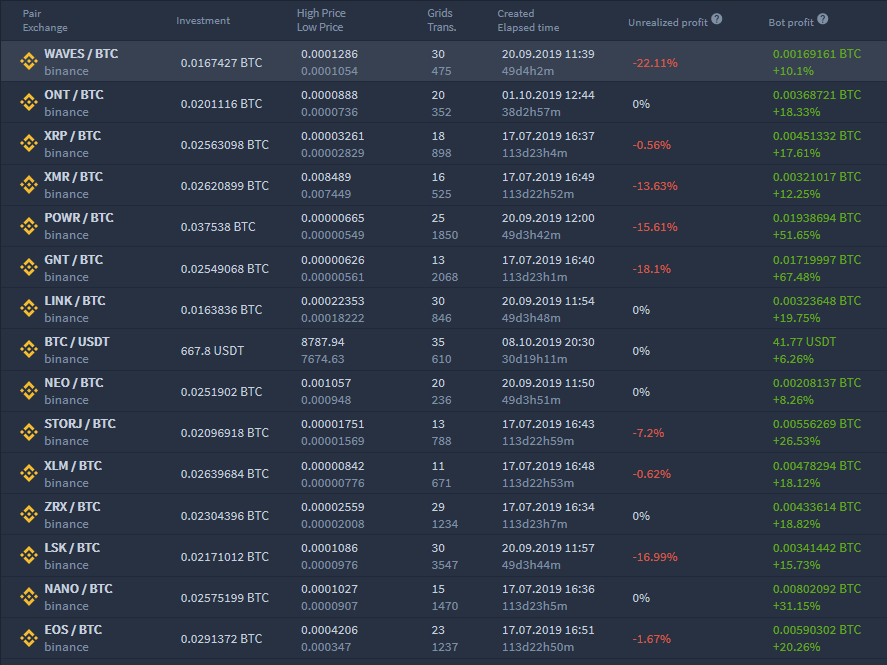

Now let’s check the status of my current bots launched with Bitsgap. 6 of 15 pairs have crossed the upper level of the trading corridor. They have earned some profit, but they are now waiting for the price to go down to buy again.

The remaining bots have crossed the lower level of the trading range, meaning that they have bought the altcoins and they are now waiting for the moment to sell them off. Only a couple of the pairs are still inside the range and continue to make me profit.

This calls for some changes in the trading bots, which I am going to detail later in the post. For now, it is time to discuss a major update in terms with my trading bot program.

🚀 Trailing Bot Launch

There was a massive update at Bitsgap, where the trailing bot feature was added to the program. What it means for me is that I can set the bots with moving upper and lower levels, which will allow ranges to move together with the price. This will help reduce the number of situations when my bots are leaving the range.

This will also minimize the need to adjust my bots manually. But seeing that this is the first time that this feature is being used in Bitsgap trading bots, I plan on being more involved with my bots in the next week anyway.

To test out the trailing feature, I am going to close and re-launch 3 pairs with this option enabled in them.

These are the pairs that we are going to test the trailing bot with: NEO, ZRX and LINK. All three of them have now left the upper range and have brought me some profit. This makes them the perfect candidates to be adjusted with the new feature.

Let’s take the ZRX/BTC pair as an example. I have chosen to move forward with 25 grids, with 0.41% profit per grid and an investment of around 0.025 BTC. Trailing is activated and the bot is now launched.

Next up, let’s make some tricks to the WAVES pair. As it shows in the image below, there is a new corridor available. This gives me the chance to make adjustments without affecting my profits negatively.

This bot is now canceled for the new re-creation. I have decided to adjust to the mode when it will first sell off the coins and only after that will it put new orders to buy. I don’t want it to buy more WAVES right at the start. This is the reason why I picked the current price as a lower limit.

My last edit for today is the BTC/USDT pair. After a massive pump of Bitcoin, it has also left the corridor, bringing me 41 USD in profit. Now, I will relaunch it in an opposite approach that I took towards WAVES. I want it to buy Bitcoin first, and only after that allow it to put the selling orders.

For that, I have chosen a current price to become my upper limit. It looks like this can work because according to the chart, Bitcoin should go down for a correction. When that happens, this bot will get the perfect opportunity to show me its performance.

What I really like about this experiment is that I get more knowledge and understanding of the trading mechanism every time I make the report and adjustments. When I first launched the bot, I had next to no experience with trading. But now, I can definitely see some patterns and understand what to do next just by looking at the charts and graphs that are presented to me by trading bots.

This has proven to me that you don’t need years of experience for successful cryptocurrency trading. When you are willing to learn the details and nuances, you can get a good grasp on trading within a few weeks itself. From there, you can evolve your skills further with time. All you need is the willingness to learn, and some practice to go with it. As you have seen in the past few weeks, I am all for channeling these traits for the success of this experiment.

The only problem that I have is my laziness, which does not allow me to make adjustments on a daily basis. Well, hopefully my recent record earnings will motivate me to be more proactive, write more reports for you, and earn more profits with automated bot solutions. See you next time!