Today I will share the details of my experiment with a Dogecoin bot. I have launched an automated trading tool with a BTC/DOGE pair two months ago and was able to make a solid profit. Keep reading this report to know more about the results, strategy, and setting that I was using.

As stated above, the Dogecoin bot was running for around 60 days. To launch this algorithm I used the Grid bot strategy, provided by Bitsgap. This is not the first experiment that I do with this service. Bitsgap has been my main automation solution for almost two years already. You can check my previous reports to know more about my trading journey.

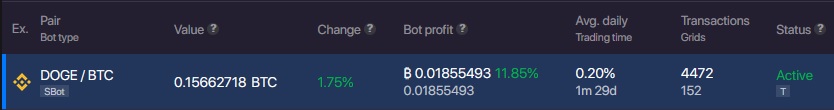

With all the hype surrounding Dogecoin (DOGE) nowadays, I decided to trade it with a bot. The price of DOGE is moving up and down all the time, which is a perfect situation for the Grid strategy. My total investment for this experiment was 0.1566 BTC and right now my profit is 0.018 BTC.

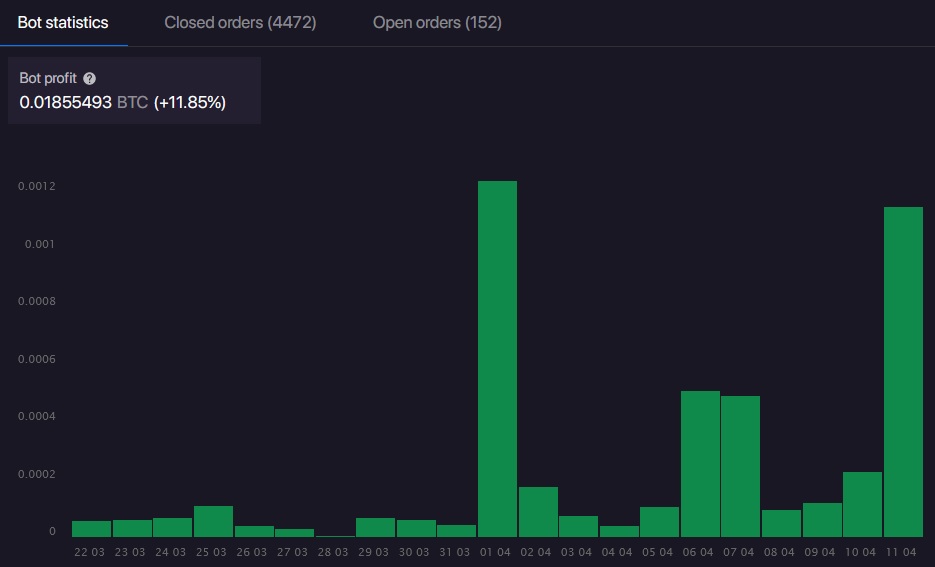

Here are all the details about the Bitsgap bot and its performance so far. The green color represents the buy orders and the red color represents the sell orders. The total number of executions is currently 4472.

Here you can see the actual profit made day after day. At the beginning of April, the price of DOGE has performed another upward rally, which helped the bot sell more coins and get more revenue.

How does it work?

If you are not familiar with the Grid trading strategy, let me explain how it works. To launch this BTC/DOGE bot I have started a new SBot by Bitsgap. Of course, you also need to connect the bot to your exchange and deposit some cryptocurrency. In my case, I already had the Binance exchange connected to the Bitsgap and some Bitcoin laying on the account that I could use.

After you choose a pair to trade, Bitsgap will offer you all other settings. The bot will suggest to you the setting that could work the best with the trading pair you selected. These settings were backtested on the historical data.

This does not mean that the coin will be making the same movements in the future. However, it still gives you an idea and a starting point to launch the bot.

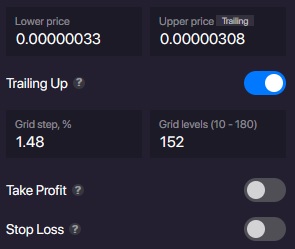

My settings are the following:

- Lower price: 0.00000033

- Upper price: 0.00000308

- Grid step: 1.48%

- Grid levels: 152

- Trailing up: is activated

My initial investment is 0.1566 BTC, so the bot has taken this amount, divided it by two, and bought DOGE for half of the investment size. After that, the bot has created a grid of orders: 76 orders to sell DOGE for BTC and 76 orders to buy DOGE with BTC (total 152 orders).

The grid step shows the gap between the orders. For the buy orders, each of the 76 orders placed is 1.46% lower than the previous one. The same happened with the sell orders: each new order is placed 1.46% higher than the previous one.

The total number of orders inside the grid is always the same: 152, but the amount of buy and sell orders may be different and determined by the market movements. If the price of DOGE goes up, then the bot starts to execute the sell orders and at the same time puts new buy orders for the replacement.

The trailing up feature will allow the bot to modify the trading range if the price of the coin will cross the upper price limit. In this way, the bot will continue to execute the orders without your manual interaction.

The minimum investment needed to launch the Dogecoin bot with these settings is calculated according to the minimum order sizes available on your exchange for the selected pair. The amount of investment can be lowered down by using fewer orders in the grid. The more orders you have in the grid, the more often the algorithm will be executing the deals. The same strategy can be used with fewer orders in the grid and lower investment.

Are the results good?

Almost 12% of profit is a good result for two months of trading activity. During this time, the bot has never left the trading range, as the lower and upper limits were pretty wide. I will keep this bot up and running and hope to see even better results soon.

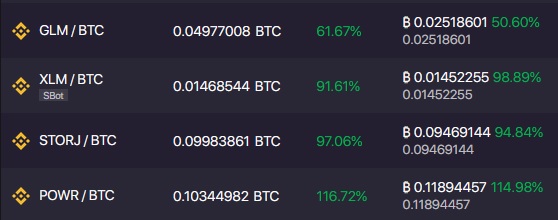

Besides DOGE/BTC pair I also run four other bots with a Grid strategy, which are doing fantastic. They have all launched a long time ago, but are still showing good results.

For my next Bitsgap report I will probably try to find some new pairs and launch more bots, as my current plan allows me to trade up to 15 pairs simultaneously.