Recently, the Bitsgap platform has added a Combo bot to its arsenal, which allows you to launch automated crypto trading on the Binance futures market. As a true Bitsgap fan, I decided to put the new bot to the test and prepare this report describing all the nuances. In this report, I share the profit I made in one month executing the bot and my tips for a successful setup of the Combo bot trading.

I am not a professional trader and this is the reason why I use trading bots to grow my crypto portfolio. While I understand how the spot market works, the futures market is something new to me. This is the reason why I had to educate myself during this experiment. In this report, I try to explain all the settings and numbers in the easiest possible way. I want to make sure that all futures trading newbies will get the point.

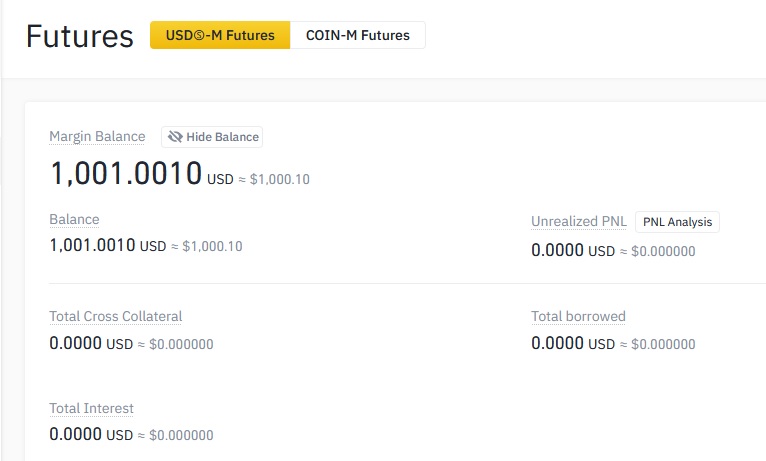

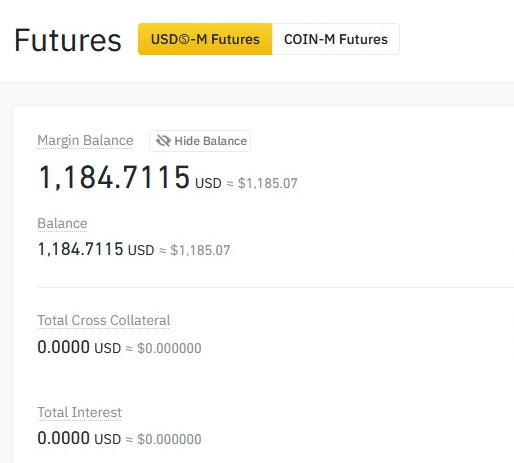

Now let’s move to the action! Before launching the Combo bot, you need to connect the Binance Futures market to Bitsgap via API. After that, you also need to enter your Binance account and transfer some funds to the futures wallet. I decided to put 1,000 USDT into my futures account. This is the starting amount for the whole experiment.

Setting up the Bitsgap Combo bot

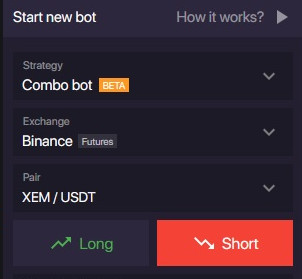

Now let’s move to the bot settings. First of all, you need to select the strategy and exchange you want to use. Then you will also need to choose a trading pair and decide if you want to go long or short.

- If you think that the pair will be growing in price, then you should pick a Long strategy

- If you think that the price will be falling, then you need to go with a Short strategy

I have checked the charts and decided that the pair XEM/USDT will be falling in price, so I picked a Short bot here:

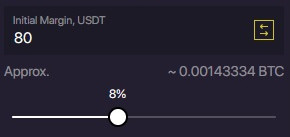

Now you need to set the initial margin amount. Right now Bitsgap will allow you to use max 50% of your balance for that. I decided to go with 80 USD.

NB! As we are dealing with leverage trading, be informed that in case of a bad scenario, you can lose more money than the initial margin amount. The remaining funds of your balance will be used as collateral. Remember, that here you are borrowing money from the exchange, and if your position gets liquidated you will have to pay the loan back.

Now you need to select the leverage level. The maximum leverage level allowed is 10x. I decided to go with 5x. The higher leverage you select, the lower your liquidation price will be. I would not recommend making it higher than 5x, otherwise, it can be too risky. You could get liquidated really fast.

Next, you will need to choose Cross or Isolated margin mode. This is important when you launch more than one bot. With Cross Margin the whole balance you have will be used as collateral to each bot you launched. With Isolated Margin, every bot will have its own balance, which you can fulfil if needed.

As I am launching only one Combo bot this time, I will be using the Cross-leverage mode. But for the next experiments, when there will be more bots running simultaneously, I would rather use the Isolated mode.

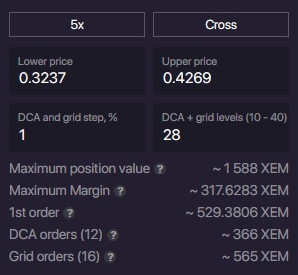

Lower and upper prices, steps and levels were all suggested by the Bitsgap itself. I did not make any changes here. The Combo bot is using a combination of the DCA and Grid levels.

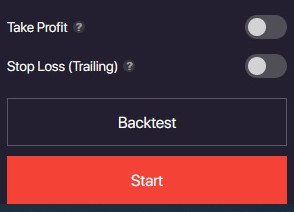

After it, you will have to activate the Take profit and Stop Loss features. I did not set these parameters when launching the bot and it was a big mistake. It is really important to set these parameters up, as the price of the cryptocurrency you trade can change the direction very fast, and you can get into a situation that I will describe below.

This is how the Grid and DCA orders look like on the chart right before I launched the XEM/USDT bot.

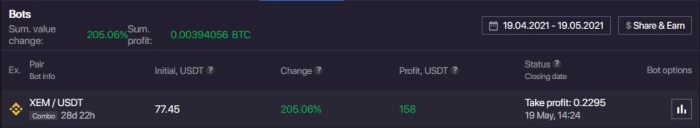

Now the bot is launched, and this is how the summary looks like:

Massive Combo bot profit right after the launch

As I was expecting, the price of XEM has started to move down during the next four days. The Bitsgap futures bot was able to make around 83 USDT in total. Basically, this was a perfect moment to end this experiment and get the profit, BUT I did not set the Take-profit amount. The price of XEM started to grow, and as you can see the bot did not make any profit during the next 23 days!

The price trend changed

Now, this is the time to talk about the importance of take-profit order while trading with Combo bot. The price of most cryptocurrencies moves really fast, and this can play a dirty trick. This is especially true when trading with leverage, as a change in the trend could easily burn a large part of your balance.

Moving forward, I got into a situation in which the bot has made some profit, then the price direction changed upwards, and my futures position became negative (as I was trading with a Short position). On the screenshot below, you can see that the actual profit loss (P/L) became -116 USD.

Several days later, the P/L was already -202 USDT, as the price of XEM continued to grow. This was the moment when I decided to activate the stop-loss. The liquidation price was 0.7127 USDT and I put a stop-loss below that on 0.5309 USDT. To be honest, here I already thought that my first Bitsgap Combo bot testing will end up with a significant loss.

A few days later, the price has changed trend again and started to fall. This was a perfect situation for me to catch the profit and close the bot.

Here, I decided not to catch the positive moment to close the position manually, but to place a take profit order at XEM price 0.23 USDT. The bot hit the target pretty soon and completed the performance automatically.

What profit could Bitsgap Combo bot generate?

While the Bitsgap bot showed me a profit of 158 USDT, the actual numbers on the Binance exchange were a bit different. After the Combo bot completed its trading, my Binance futures balance was 1,184 USDT. I am not sure why there is such a difference, maybe this issue is related to the massive Binance lag that happened this day.

But what I know for sure, it that the Bitsgap futures bot could make me around 185 USDT in profit. Having no stop-loss and take-profit orders on the start was pretty risky, but as I said at the beginning, this was my first experience with futures trading.

For my next experiment, I will launch several Combo bots and I will try to properly configure them, taking into account all the experience I got so far.

Top 5 tips for the first-time Combo bot launchers

These are 5 tips I learned from the first experiment that will be helpful for you if you are just about to launch your first Combo bot:

- Determine whether the market is going up or down. This will help you to choose between Long and Short strategies

- Use Isolated margin if you are launching several cryptocurrency futures bots

- Do not use more than 5x leverage

- Set up a stop-loss on the launch. Place it a bit below the liquidation price.

- Set up a take-profit level as well. Depending on the strategy, this could be placed somewhere around the coin’s support or resistance levels.