Today I am going to show you the process of launching futures bots with short and long strategies. I will do this on the Binance futures trading exchange via the Bitsgap platform. Several months ago, I have published the first test of the Bitsgap Combo bot, you can check it here.

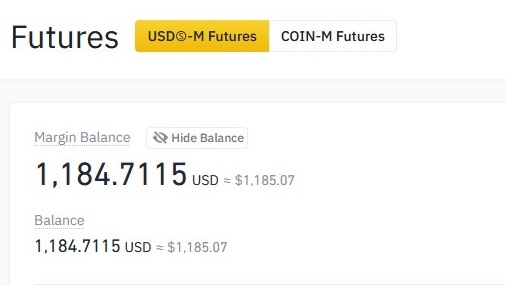

This report will contain more details than the previous one, as it took me almost four months to perform this experiment. My starting balance on the Binance futures account was 1,184 USD.

During the testing process, I have launched and closed four different futures bots on the BTC/USDT pair: two with short and two with long strategies. All these bots were launched one after one, each of them had its own running time, but they all were closed with profit.

Keep reading this report to see the settings I was using and the profit that was generated during this experiment.

Launching short futures bot

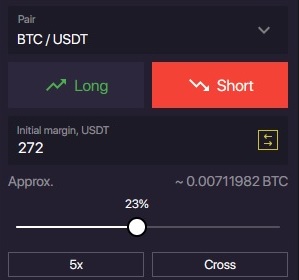

The first bot I launched was using the short strategy. Here are the settings I’ve used:

- Initial margin: 272 USDT

- Leverage: 5x

- Margin mode: Cross

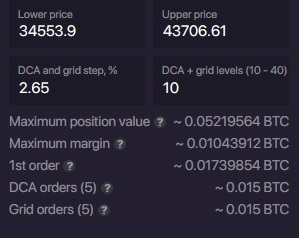

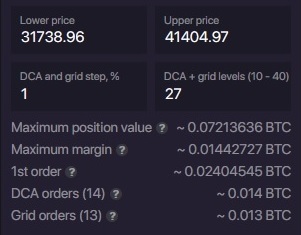

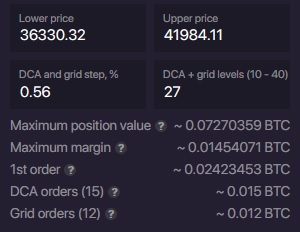

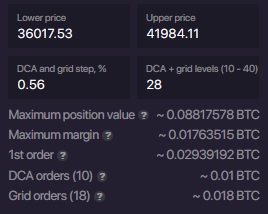

The lower and upper price ranges were proposed by the Bitsgap service itself. The same happened with the DCA grid step % and levels:

Here is the BTC/USDT chart prior to launch. You can see the upper and lower prices here together with the stop loss and take profit levels.

I’ve placed the take profit order above the lower price range. Instead, the stop loss has been set up just below the upper price.

This bot has been set up with a short strategy. It will make money if the price of BTC goes down. That’s why we have a take profit order on the bottom and stop loss on the top of the chart.

The bot has been launched as follows:

Two days later, Bitcoin’s price went down and hit my take profit level. I was able to earn around 70 USDT. This was the fastest bot to reach its target during the whole testing period.

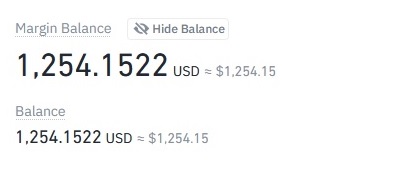

Here you can see the balance that the Binance platform was showing:

Here there is a summary of the bot:

- Strategy: Short

- Time running: 1 day, 10 hours

- Profit: 70.51 USDT

Testing long futures bot

Now, let’s move to the long bot settings that I launched right after the previous short position was closed.

- Initial margin: 351 USDT

- Leverage: 5x

- Margin mode: Cross

All further settings were again advised by the Bitsgap platform, which is really helpful:

This is the chart before launching the long bot. I did not select any stop loss and take profit level before starting as there is always a possibility to add those later.

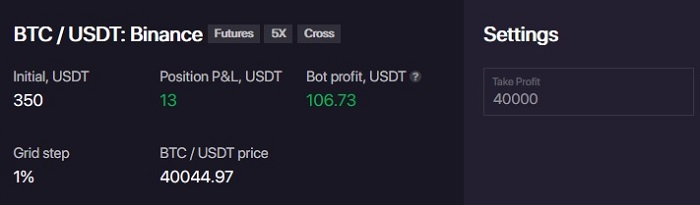

I have set the take profit order at a price of 40,000 USDT. In seven days, the price hit the expected target. With a long strategy, the price should move higher in order for us to make a profit.

Let’s double-check the profit amount on the Binance account:

Summary of this bot:

- Strategy: Long

- Time running: 7 days, 2 hours

- Profit: 106.73 USDT

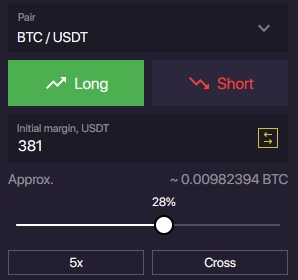

Another long futures bot tested

Next, I decided to launch a long strategy again. How do I decide which strategy to use? I will share my thoughts on that later in this post.

- Initial margin: 381

- Leverage: 5x

- Margin mode: Cross

Here is the chart of the BTC/USDT pair prior to the launch. Here I also decided not to select the take profit and stop loss levels at the moment of launching the bot.

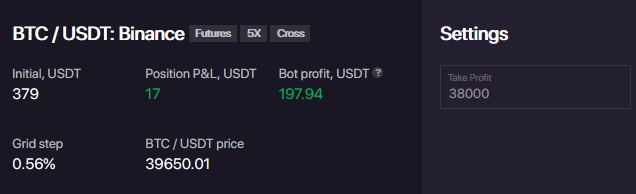

After launching the bot, the price of BTC started to fall, a bad scenario for a long strategy. I had to wait for more than a month for the price to recover. The take profit order at 38,000 USDT was placed in the middle of this experiment.

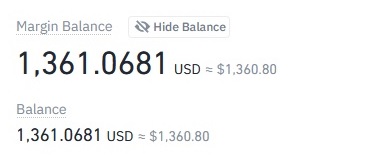

The total balance of my Binance futures account kept growing:

Summary of this bot:

- Strategy: Long

- Time running: 1 month, 7 days

- Profit: 197.94 USDT

The final short bot launched

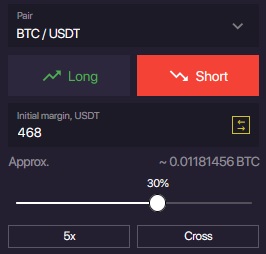

This is the last bot that I was running for this test.

- Initial margin: 468 USDT

- Leverage: 5x

- Margin mode: Cross

When I was launching this bot, I actually thought that this one was going to be one of the fastest and most obvious decisions. The price of Bitcoin had been on an uptrend for several days prior to launch, so I decided to open a short position here waiting for a correction.

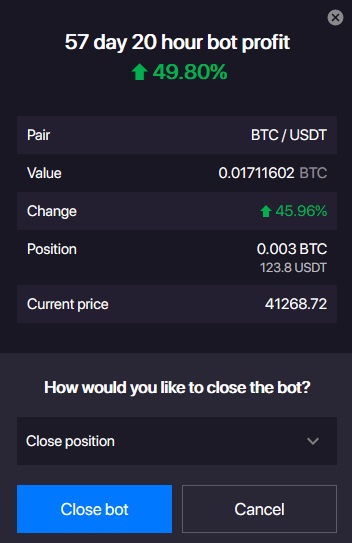

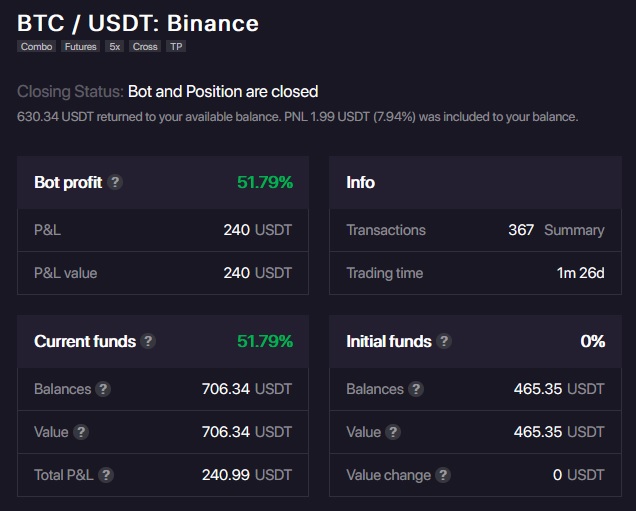

Unfortunately for my bot trading strategy, the price of Bitcoin continued to grow, which was the worst-case scenario for my short position. It almost took 58 days for Bitcoin’s price to go lower, which made it possible for me to manually close the position with profit:

During that time, Bitsgap was updated. The screen in which it shows the stats for the closed position changed and it now contains much more information:

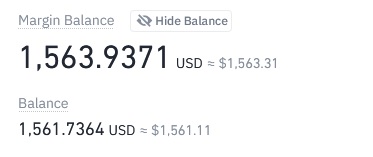

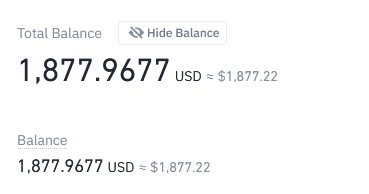

This is the final balance of my Binance futures account:

Summary of this bot:

- Strategy: Short

- Time running: 1 month, 26 days

- Profit: 240 USDT

Overall results of this crypto futures bot trading experiment

Now let’s make some final calculations:

- I started with: 1,184 USDT

- Ended up with: 1,877 USDT

- Profit: 693 USDT (58.5%)

- Bots were running for: 102 days

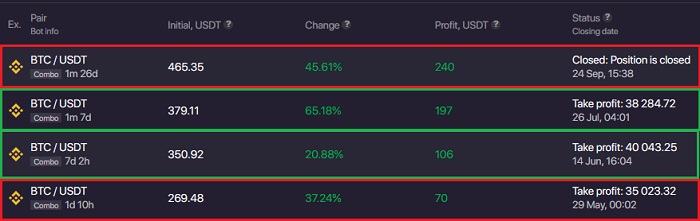

On the next screenshot, you can actually see the stats of each bot. I have colored the short bots with red and the long bots with green color:

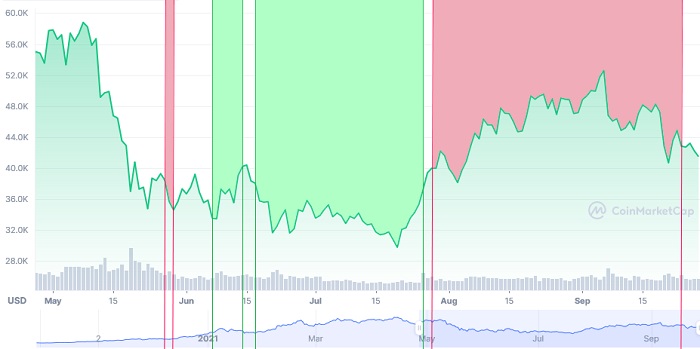

Here you can find the price of Bitcoin for the whole experiment period. I have also marked the trading periods for each of the four bots:

How do I decide which strategy to launch: short or long?

As you can see on the screenshot above, I was only able to guess Bitcoin’s movement twice: for the first short and long bots. There, the price was moving in the direction expected.

With the third and fourth bots, the price moved completely in the contrary direction to what I predicted. I still managed to finalize every deal with a profit thanks to being patient. But still, you won’t be able to guess the future move of the price of Bitcoin every time you launch the bot.

Here you need to understand the main characteristic of crypto assets: volatility. So, if the price was moving up, it should move down one day.

There are also multiple indicators that can help you to understand if the market is bearish or bullish. So, you can rely on these indicators if your trading experience allows you to apply and read those.

During this experiment I was only hoping for price corrections: I tried going short after the price experienced a continuous move higher, and I tried to trade with a long position after a price drop.

What is more important, it is necessary to have patience here. Sooner or later your position should reach the goal, so don’t make any drastic decisions, and don’t close your positions with losses. If you have picked a wide trading range and did not use large leverage, then you should not fear liquidation.

Did I manage to get a nice profit? Absolutely! 58.5% in profit for three and a half months of trading is a really good result despite the fact I had to wait several months for the last two positions to close.

I will keep doing my experiments with crypto futures bots, so make sure to check for the new reports soon!