I have launched my KuCoin grid bots more than two months ago, and this is my second report where I will show how these bots performed so far. Check out the first report that I have made after one month of trading to better understand the things I am going to show today.

I have started this KuCoin experiment by depositing 0.03 BTC into my account. The goal is to test out the free automated trading tools provided by KuCoin and to understand if those bots are worth it.

Reviewing my current KuCoin bots

Right now there are seven different pairs running with an automated grid strategy. All of these bots are already live for 78 days. Let’s go through every pair and analyze one by one to understand whether they are good pairs to trade with a KuCoin grid bot.

DOGE/BTC

This pair has 14 buy and 86 sell orders active at the moment. It means that the bot purchased many DOGE coins, and the bot is now waiting for a price correction to sell them back.

- Number of trades: 2117

- Total profit: -5.55%

ETH/BTC

This pair was able to generate a small profit and has a slightly lower number of selling orders compared to the DOGE/BTC grid bot. The ETH/BTC pair has 69 selling orders to be exact.

- Number of trades: 628

- Total profit: +0.92%

LINK/BTC

This pair has brought a large profit. The buy and sell orders are almost balanced, meaning that the LINK/BTC pair is being traded in a perfect price range.

- Number of trades: 2124

- Total profit: +7.63%

LTC/BTC

Litecoin behaves pretty much the same as Ethereum. It has generated a small profit as well.

- Number of trades: 1385

- Total profit: +1.80%

XEM/BTC

This one is the worst-performing pair so far. The bot will be able to make a profit only if the price of XEM starts to grow. The bot has to execute 88 sell orders.

- Number of trades: 1963

- Total profit: -8.50%

XMR/BTC

This is another pair that you can consider picking for your automated grid trading strategy.

- Number of trades: 1483

- Total profit: +1.43%

KCS/BTC

This pair was one of the best in my previous report, but recent cryptocurrency volatility totally killed the profits generated during the first month of trading.

- Number of trades: 1447

- Total profit: -5.07%

TOP TRADING BOTS

My KuCoin bot profit after two months of trading

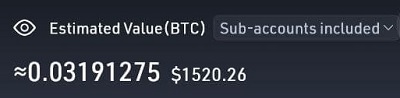

Now it is time to check the results after two months of automated KuCoin trading. I finished the first month with 0.0319 BTC.

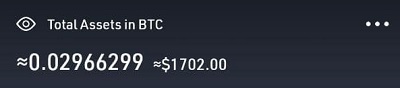

Today, my balance is worth more in USD terms, but if we check Bitcoin’s value, then it went lower: I now have 0.0296 BTC.

The goal of my trading activity is to accumulate a larger amount of Bitcoin. My current balance is even lower than my deposited amount of 0.03 BTC, which is sad.

The explanation for this situation is quite simple: the bot purchased lots of altcoins and I should expect to make a profit after a market correction. Right now, the price of Bitcoin is at 60k, which is near to an all-time high. The situation should stabilize as soon as Bitcoin’s price steps into a flat period.

How does Bitcoin volatility influence the grid bot profit?

It is not a secret that the price of Bitcoin is moving the whole market and influencing trading activities a lot. Let’s check how Bitcoin’s volatility can help or affect the earnings using a grid strategy.

In the next screenshot, you can see the daily profit generated by the bot compared to the BTC price. It is clear that grid bot results are heavily correlated with market movements. Positive profit spikes occur when Bitcoin hits new highs. Income decreases when Bitcoin falls.

Another chart that we can compare is the profit generated by the bot day after day. The biggest red bars, which indicate negative profit results, were formed after massive Bitcoin drawdowns.

The grid strategy is perfect for a flat or slowly growing market, but it can be dangerous to use when the market is falling. During a falling market, I would suggest you try launching a short futures bot. You can check my other report to find out how to set it up and what profit can be generated.

Is KuCoin trading bot worth it?

The KuCoin bot has one of the strongest advantages when compared to other automated trading solutions – it is free of charge. Yes, you still pay a small fee on every order execution, but this is something that happens on every exchange.

The accessibility offered by the bot makes it a perfect solution for any crypto market newcomer willing to try automated trading strategies. KuCoin’s trading bot is definitely worth trying, as your risks are very low. In the worst-case scenario, you can just stop all your activities and withdraw the balance back to your wallet.

Using a bot tool will help you to automate your trading strategies, but it won’t make you rich without your personal control. You have to constantly monitor the market to spot those clear opportunities to launch the bot. You also need to catch the correct moment to withdraw your profits.

Right now, I will wait for a market correction and allow the bot to sell out all the altcoins that it has bought so far. After that, I will close all seven bots and make a final report, so stay in touch.