The reason why people go into the cryptocurrency industry is innovation and money. But mostly for the money that they know, the sector can bring to them. Many people have made their fortunes in the digital asset space in several ways.

A few chose to become entrepreneurs and build tools and infrastructure companies to help enhance the emerging sector. Others decided to go straight to where the money is by becoming traders.

Of course, speculation does not guarantee earnings and comes with an element of risk that one can not quantify. People who placed their bets early saw large rewards and might still stick with the crypto industry to live a better life.

The main question now is what the future looks like for the industry, if it will become much better, and provide significant returns over time. Those who are speculating and investing right now seek to see the value over the long term. What about those who are interested in the near future returns?

They can trade in the usual way or do so in an automated fashion. They care not about tomorrow in three years brings but what happens in the here and now. They want to see how much they can earn right now and the best way to do that.

More people are turning to automated bot programs to achieve returns in the short term.

Why?

They want to streamline their trading experience in several ways. Let’s find out how.

💸 What Profits Trading Bots Guarantee?

Remember that these automatons help in two specific ways. The first way is through saving time, and the second way is by helping to generate money.

Now, we know for a fact that these bot helpers can help to save money. Traders are able to input specific instructions, choose strategies, and then go on with other activities in their lives. The ability to do so brings about fascinating opportunities. But the real question is if the bot can generate more value for traders if they give it a chance.

Many different companies and crypto projects state that they create algorithms and data-driven tools that use AI and machine learning to deliver optimal results. Again, if they delivered such great results to a good portion of people, everyone would be using them and would be fabulously wealthy.

We do not see that phenomenon in the markets just yet. Can machines deliver profits through trading? Sure, but how effective are they at doing so?

That is the current era’s question, and many seek to answer it through trial and error. We are still trying to find the right answer to this question and will likely have a definite and positive answer soon.

The simple truth is that bot services do not guarantee any profits. If they did, at the present moment, they would likely be false and liars. The truth is that these programs are not as effective in a mass-market way. We know that this is a fact because everyone can not magically generate money through trades.

The money markets have not worked like that in the past. Nor will it work like that in the present or the future.

Zero-sum games run rampant in these financial markets. This aspect of zero-sum games is true, whether it is in the traditional finance area (stocks) or the digital asset industry (crypto). The idea with the zero-sum games is that someone loses money, and someone else captures that money.

Again, there is no magic bullet to trading as of yet.

That is why many users think twice about how they will act and see results with their automated bot programs. Many people search and conduct rigorous reviews and do in-depth research on their own to see how other users are doing with their augmented helpers.

But how else can you prepare and increase your profitability opportunity? Here’s a simple process.

🚀 I have tested several trading bot solutions with real money investments. Check out my reports to find out the details.

Strategy and Goals

The primary step is to set a personal investment strategy and understand what you want to do on this automated speculation journey. But what does that entail?

Remember that the amount of funds matters when you start this process. Most people will choose to begin with at least $1,000 worth of currency. The more you have to start, the longer you likely can stay in the game. But even then, skill matters, not the skill of the bot platform, but yours.

The market inefficiencies are always present in the market in some form or fashion. It is up to you to realize where they are, how they work, and how to profit from them.

The proper first step in your journey will require you to think deeper and go further into your psyche.

It will require you to think about the number of funds you have at the current moment and then decide where you want to allocate these funds. You must think very carefully about your goals in the present year and in the next one.

Do you have an investment time period? Will you invest in the market in specific timeframes? Are you interested in reinvesting the money you earn from the markets?

How much money are you trying to make at the end of each month or the end of each year?

Do you want to earn a lot of money at once, or are you okay with winning a little bit each day?

Please record these answers somewhere within your journal. That is right; you will need to proceed to create a simple journal of your trading decisions.

The trading journal can be digital or offline. Also, remember that the way you set up your decisions and trading strategy should be current with the data instead of the heart or gut.

There are two comprehensive ways to look at the market to make money.

Those who want to earn with digital assets can do so by holding assets and hoping that they appreciate over time. People who go with this option want to keep it simple and non-descript, they do not want anything too crazy; they just want to have exposure and minimize fees.

You might call this holding on for dear life.

The journal entries in this approach will be simple because of minimal movement.

The second aspect is day trading or swing trading. One would realize that the point here is to actively manage assets to earn over the market’s regular returns. These people seek to gain from the constant movements of assets like bitcoin by betting in the right way.

Regular trading in this digital asset market is excellent because it provides profit opportunities as long as one reads the market correctly. Again, one must look at their expected profits.

Are you in line with at least 1% profit each day? If you were to choose right and meet that average, you would be likely to earn 30% each month.

Now, you might wonder why you, the human, must do all of these things if you are trying to give the reigns of control over to the bot. Well, you must still have all of these prerequisites in place if you want to do a great job and stay accountable to yourself and your goals.

The augmented trading solution relies on you to do your due diligence and guide it. You can only guide the bot if you know what you are doing and why you are doing it.

Choosing Your Trading Bot

The subsequent step is to choose an automated bot that meets your needs. Now that you know what you are doing, what you are expecting, and have a strong rationale for why it is feasible, you are ready to start the next part of the prepping process.

This is where you would find out and declare the bot helper that is right for you. Remember that different bots come with different strategies and are relevant to you based on your goals and methods.

If you seek to conduct risk mitigation, then you are looking for a strategy that includes diversification. If you are looking for amplification of capital, you are looking for those that take on more risk with arbitrage or other methods.

The one that you choose is completely up to you and your mode of investing. It is important to note here that different bot choices do exist in the market.

You must know yourself and your strategy really well.

What are these different bots?

They range from arbitrage bots to scalpers. For instance, arbitrage automatons will look to capture the value variance between two markets, like Binance or Coinbase. They would buy low on one of them and sell high on the other one.

Where’s the value here? Besides the price variance, it is about the delay present in these different markets. One market will slowly pick up the pace, so those who move quickly can capitalize.

Whereas scalpers take on a different strategy and will run frequent orders to capitalize on small gains between bids and asks.

Those are two examples, there’s a few more options.

The more you understand the markets, the better off you are when deciding which one is best for you.

TOP TRADING BOTS

Configuration

The third step is to set up your bot to your specifications. This is not very complicated to do and is quite likely one of the most straightforward steps in the process. The reason why this is so is quite simple. Remember that many of these providers create dashboards that are easy to use and comprehend.

You must connect with the exchanges via an application programming interface. Then you let the automaton do what it needs to do with a little refinement every now and then.

We know that trading bots provide significant value because of a few components:

- They do not sleep just like the digital asset industry.

- Automations do not have emotions

- They are not as complicated as some make them out to be.

- You still have full control.

Still, this is the era of information overload and continuous connection. It is in this era that we look to each other for guidance and social signaling.

Essentially, the key is that we look to others’ experiences to understand the real merits of these automated programs. I know this because I decided that I had to learn about this world of bot trading by myself. I started on this journey quite a while back and why I want to share my learnings in this computerized trading sector.

🦾 My Experience with Trading Bots and Returns

I don’t know if you’ve been following along with me on my trading adventure, but I’ve been here and noting my learnings right here on this blog.

The simple idea here is that I’ve been working with the Bitsgap bot for the better part of a year, and I’ve been letting people know about the bot’s experience.

Let me tell you a little bit more about Bitsgap, and I will give you a little idea about why I chose this particular program. As I know, my reasoning and thinking will help you as progress on this journey as well.

I started with the same process as I’ve outlined above, where I set my goals, looked at how I would start, and acquired my initial capital. Afterward, I went to make sure that I had a trading journal to write my notes in and move forward from there.

Now, when it came to selecting an automated helper, I decided to start my research by looking at reputation first. I found that Bitsgap had real-life quality investors, and people involved in creating the brand. That meant that I could expect commitment, longer-term services, and peace of mind.

We can see that they have a group of talented developers, a marketing team, and a strong support team.

They even have established partners in the field as well. This made me realize that they are spending money regularly to become a real competitor in this market and stay relevant.

Next, I looked at what they could offer me and aligned with my strategy overall. I did like that they did have a tab on their site for a product tour as that allowed me to check out all of the features.

These features were:

- Simplicity in trading many different tokens on various platforms with one application

- General and compelling information about the digital asset market as well as fundamental and more expert investing

- Expansive level information from a real-time standpoint

- The inclusion of grid trading

- A trustworthy program

What is compelling about the application is that it shows you information from vast markets and can take action on that information. The platform pushed the features forward by integrating grid trading strategy.

Many people appreciate the fact that there’s access to more than 4,000 coins to trade within the current environment. One search for tokens or just view the dashboard to see what is available to play with.

I could navigate quite well when looking at price charts, order books, recent trades, and viewing cumulative volume. Users did mention that it was secure that did help me make my decision as well.

I found that the platform met my needs on ease of use, security, regular innovation, and price point. Rigorous research also noted a robust community of people who experimented with it and had a pleasant experience.

With that, let us find out more about my experience, specifically how much money bots can make.

💰 How Much Money Trading Bots can Make

Here I’ll give you a quick overview of what I learned from my trading experience with Bitsgap.

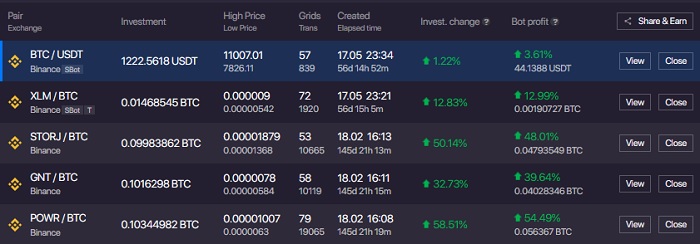

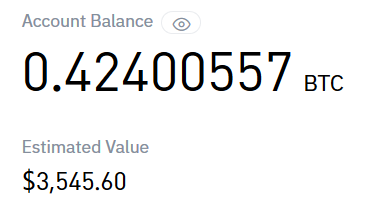

Here’s My First Report

I began my journey with 0.4 BTC and kept that money exclusively for the Bitsgap bot to see how it would work out for me.

I chose to allocate that 0.4 BTC to a mixture of 15 coins and would follow the activity and results over a month or more. In the first week, the robotic helper did work with me to earn over 0.02 BTC.

Again, over about six days, I made 0.02 btc.

I didn’t do too much tweaking of the portfolio over the first week. The automated helper did make over 1500 trades in that timeframe.

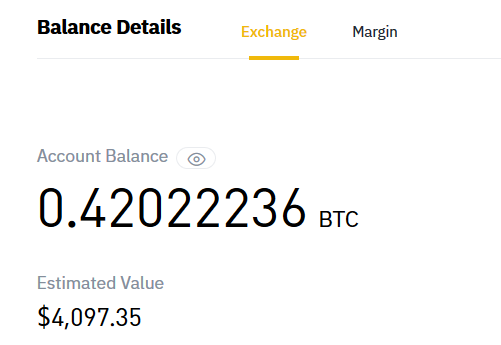

The Second Report

I realized a decrease in earnings and a little bit of loss in the second week. I made a few adjustments, and then I launched another bot and watched it over the week.

The result of this week : 0.419 BTC.

The Third Report

The market went down. My automated bot helper took a hit but still made some smart moves.

I ended the week with right now is 0.387 BTC.

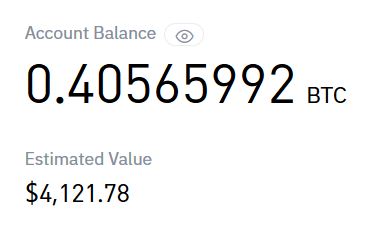

The Fourth Report

Remember, I told you I would only show you the results over the course of a month? Well, I ran the experiment for over two months because I wanted to see profit potential over the long term.

What did I end up with this week?

0.40565992 BTC.

I’m slightly up again.

The biggest lesson this week was that these tools are helpers and must have a constant watch.

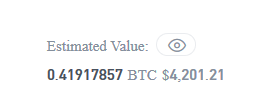

The Fifth Report

This next report is where I’m up again, and I’m back in profit mode. But this took place because I did the work and made adjustments to the robot parameters.

The profits came because the market did well and because I made the right adjustments. I learn in this time period that volume matters and that regular growth in volume is a positive indicator. Remember that I’m still running more than ten automatons.

I ended this period with 0.424 BTC.

Slowly but Surely

During the next couple of weeks, the Bitsgap bot was making small profits, adding 0.01-0.03 BTC to the balance weekly.

Finally

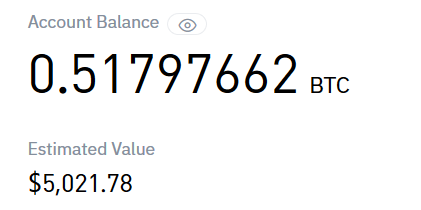

Ok, the experiment went longer than I thought it would. What started as an experiment for one month turned into a six month long experiment.

Over the course of six months, I was able to turn my 0.4 BTC into 0.5 BTC.

The main lesson that I learned was these tools can help, but they are still tools that require someone to wield them. That is an essential lesson as many people think that these bot tools will do all of the work for them.

They then become disappointed because they think that it will provide them with significant value without doing anything. The truth is that they will help, but you will have to understand the markets and adjust the parameters of your trading tools accordingly.

These helpers do save time and can generate value, but you must be quite careful and diligent.

As you saw, my journey had its ups and downs, and I finally overcame and increased my value a substantial amount.

📢 Conclusion

People have been talking about trading bots since the 1950s and how they would take care of all aspects of life. It is still not the case, we have more electronic equipment with motors and varying levels of intelligence. But we do not have augmented machines that cater to our every whim.

The same is true for the field of finance and digital assets, the lure lingers for novice and professional speculators in cryptocurrency. If these automated bots can offer significant value, everyone can earn a living by setting up a dashboard.

Passive income is a real and viable option, but it is not something that is easily obtained with digital asset automatons. Remember that most of these tools’ creators might have the best intentions while a select few are scammy. But if you are looking for easy money, this is not the place to do that.

These tools serve your mind, and that is why you must stay sharp. Crypto markets are volatile and change with the winds, and you must adapt. These helpers can execute your strategies but can not make heads or tails of the value of bitcoin, events, and other fundamental information factors.

Always remember that the bot is as smart as the people who are running it. What that means is that you must always look at the market and adjust the aspects accordingly.

Again, that means that you should always optimize the settings and the pairs as needed.

You might think, wait, I still must do a significant portion of work even with these tools? Not as much work if you were doing it by yourself. The automaton takes the actions for you instead of you sitting in front of the computer all day.

The good news here is that you still matter and have the chance of earning more than robots. Take into account your entry points, the ladder range, the stop, and the ultimate target.

Be careful, be bold, and win.